2(22)2019

Barbara Jancewicz1, Stefan Markowski2

Wealth formation by economic agents and their international mobility:

towards an eclectic migration

decision-support framework

Abstract

International migration has been a major influence on the economic and social development of nations. Nevertheless, a vast majority of the global population continues to reside in their country of birth. While income/wealth differentials between states create centrifugal forces responsible for migration, impediments to international mobility of human, financial, physical and social capital assets work in the centripetal direction. This paper reviews a large segment of the extant literature on international migration to probe economic influences on people’s international mobility and immobility decisions. It aims to refine and extend the neoclassical foundations of migration theory and to outline how potentially complex decision mechanisms used by potentially mobile economic agents may be modified to simplify the complexity inherent in such choices so that immobility is often a default outcome of indecision.

Keywords: migration theory, international migration, economics of migration

JEL Classification Codes: F22, D01, D19

DOI: 10.33119/KSzPP/2019.4.2

Międzynarodowa mobilność i formowanie bogactwa przez agentów ekonomicznych: w kierunku eklektycznych ram wspierających decyzje migracyjne

Migracja międzynarodowa miała istotny wpływ na społeczny i gospodarczy rozwój narodów. Zdecydowana większość populacji świata nadal jednak mieszka w kraju swojego urodzenia. Z jednej strony różnice w dochodach i zamożności państw stanowią siłę odśrodkową motywującą do migracji, z drugiej strony utrudnienia w swobodnym przenoszeniu się kapitału ludzkiego, finansowego, fizycznego jak i społecznego stanowią siłę dośrodkową, motywującą do pozostania w miejscu. W niniejszym artykule dokonano przeglądu znacznej części literatury na temat migracji międzynarodowej pod kątem wpływu czynników ekonomicznych na decyzje dotyczące międzynawowej mobilności i jej braku. Artykuł ma na celu udoskonalenie i rozszerzenie neoklasycznych podstaw teorii migracji, nakreślenie, w jaki sposób ekonomiczni agenci (potencjalni migranci) starają się uprościć skomplikowane mechanizmy decyzyjne oraz pokazanie, jak w przypadku niezdecydowania domyślną decyzją staje się pozostanie w miejscu.

Persistent economic and demographic asymmetries between nation states have been powerful generators of cross-border movements of people and this is likely to continue in the foreseeable future (UN, 2015). The proportion of international migrants, defined as foreign-born persons residing temporarily or permanently in-country, accounts for nearly 3.5 percent of the world’s population (244 million people in 2015; UN, 2016: 21). Between 2000 and 2015, high-income countries received a net average of about four million immigrants annually from lower- and middle-income countries (UN, 2015). Not only do traditional immigrant destinations, such Australia or Canada, but also countries that not so long ago were sources of emigration, such as Ireland, now have a foreign-born population exceeding ten percent of the total (OECD, 2017). It is increasingly apparent that international migration is likely to remain as ubiquitous this century as it has been for the past 150 years.

There has long been a tendency in the economic literature to treat this cross-border migration as primarily the movement of wage-earners seeking to take advantage of wage differentials and variations in employment conditions which persist between different national and regional segments of the global economy (see Zimmermann and Bauer, 2002, Vol. 1, Part I; Constant and Zimmermann, 2013: Parts I and II). As the Nobel Prize laureate Sir John Hicks observed, it is “differences in net economic advantages, chiefly differences in wages (that) are the main causes of migration” (Hicks, 1932). The international migration has, therefore, been seen as an outcome of efficient labour market arbitrage, which redirects workers from low- to high-wage destinations and from areas of un-/under-employment to job-rich locations.

However, given large income differences between countries comprising the poor South and the rich North, the 3.5 percent share of foreign-born people in the global population appears to be rather small. Notwithstanding the recent surge in migrant numbers crossing the Mediterranean and the presence of millions of ‘illegal’ immigrants in the USA, an obvious question an economist would like to ask is not ‘why so many have migrated?’ but ‘why only so few?’

An obvious response to this question attributes the apparent spatial immobility of people to a plethora of border controls and restrictions on inflows of migrants, which have been imposed by high-income nations and impediments faced by poor and relatively unskilled job seekers from the South in labour-importing countries of the North. Thus, only a small proportion of those willing to move have actually been able to migrate. The proponents of the unimpeded factor-mobility (e.g., Clements, 2011) have, therefore, argued that there are massive potential gains to be realised from easing these wealth-diminishing migration restrictions.3 Borjas (2015) effectively debunks such idealistic calls for nation-states to abolish border controls and allow unimpeded flows of migrants: if “billions” rather than tens of millions of people moved from the South to the North, there would be prohibitive migrant absorption costs, which the North would have to bear and the resultant net gain for the global economy would most likely be negative.

Moreover, to attribute the entire observed human immobility to the presence of border controls and migration restrictions is somewhat simplistic. For example, in developed economies, unemployed or underpaid workers are often reluctant or unable to move to job-rich and higher-wage locations, even though there are no administrative barriers to relocation.4 Similarly, to understand the drivers of cross-border migration we need to learn more about location preferences of those who have not moved as well as those who have voted with their feet. Any holistic theory of international migration cannot be limited to explanations of the observed migrant flows but should also probe reasons why so many people opt to remain in situ. Thus, theories of human location should not only explain the centrifugal forces resulting in people’s mobility, but also the centripetal ones affecting their immobility (Arango, 2000). While wage and income differentials are quintessential centrifugal drivers of migration flows, family and community commitments, sentiments, homeland attachments, endowments of land, physical and social capital often generate the force of gravity that keeps people in situ. The theory should, therefore, shift the emphasis of the inquiry from the homo migrantes – agents who have exercised their option to move – to the homo economicus or oeconomico (we use these terms interchangeably): the ubiquitous economic agent who may move and become a homo migantes in some circumstances but who often prefers to remain in situ and disregard apparent opportunities offered by alternative locations.

A collection of concepts that define and explain the nature of economising decisions, including the choice of location, and the associated economical use of scarce resources by oeconomicos is usually described as the neoclassical economic paradigm (see Weintraub, 2007). It is the conceptual foundation of all studies of economic activity, including economically motivated migrations. Using this conceptual meta-theoretical framework, specific economic theories can be developed to address four fundamental questions that capture the essence of the economist’s interest in international migrations:

•What factors determine the direction, size and composition of inter-jurisdictional migrant flows?

•What decision-support tools could be applied by economic agents to evaluate their locational alternatives and to determine their preferred host jurisdictions?

•How do movers detach from their home location and assimilate/integrate into their host locations?

•What is the impact of migration on the economies of the sending and receiving countries/jurisdictions?

A recent example of a specific theory of temporary migrations embedded in the meta-theoretical framework of neoclassical economics is Dustmann and Görlach (2016).

The aim of the present paper is to outline the multitude of influences, which may affect such decisions to move or stay. We argue that informed relocation decisions are inherently complex, risky and costly and, thus, the default position in such complex choices for risk-averse and boundedly rational oeconomic hominum is to defer the relocation decision or reject it. Therefore, the force of gravity that keeps people in situ is not only related to their sentimental and social attachments, natural inertia, or legal barriers, but it is also inherent in the sheer complexity of rational relocation decisions: ‘if confused or in doubt, stay put’. The paper reviews the economics-based decision-support framework, which the oeconomicos might use in their spatial and intertemporal choices as boundedly-rational decision makers. It is outlined how these agents could apply economic principles to optimise their spatial and intertemporal decisions as individuals or as members of collective decision-making entities (e.g., households, families or communities).

In short, the paper aims to embed spatial relocation decisions in the broader process of human economic activity and wealth creation, where spatial mobility of human capital is only one, albeit a very important one, outcome of resource allocation. In this context, we are interested in:

(1)the international mobility/immobility of human capital, which cannot be physically separated from its human ‘carriers’;

(2)other forms of capital (assets net of offsetting liabilities) that comprise the oeconomicos’ total wealth; and, thus,

(3)how these boundedly rational agents attribute ‘value’ to and choose between different locational options under conditions of uncertainty if they wish to take into account the impact of potential relocation on the value of their human and other capital assets.

To address the latter question, Section 2 reviews the neoclassical foundations of mobility-immobility of individual oeconomicos; Section 3 addresses the decision-making mechanics of collective decision entities; Section 4 looks at the diversity of capital assets and the mechanics of value attribution in spatial decisions of economic agents; and Section 5 draws some concluding inferences.

Individual decision maker: the neoclassical perspective

Neoclassical paradigm

The neoclassical paradigm assumes that people who engage in production and consumption of goods and services and who invest in new (production) capability formation to enhance their future wellbeing use scarce resources that necessitate their efficient and effective (i.e., economical) utilisation. This motivation to engage in efficient and effective resource allocation and use is described metaphorically as the utility maximisation objective.5 People who care about the economical use of their scarce resources and who, therefore, strive to enhance their wellbeing by seeking best opportunities for efficient use of these resources are referred to as economic agents (the neoclassical oeconomic hominum). When they choose to migrate to another location to enhance their wellbeing, we describe them as economic migrants.

In a market economy, locational and intertemporal decisions of oeconomic hominum are ‘market-mediated’. There is a plethora of international and national economic institutions, such as formal and informal markets, market intermediaries and supporting organisations that assist them in learning about attributes of different locations, opportunities for engaging in economic activities at these places and the associated options to move or remain. If these institutions are efficient, economic agents are non-randomly sorted across different points in space and over time. Thus,

“An important contribution of economic theory is to describe the kind of equilibrium sorting that takes place in this marketplace” … given … “ (…) the twin assumptions characterizing neoclassical economic theory, i.e., individuals are maximizing their well-being and the [market-mediated] exchanges among the various players lead to an equilibrium in the marketplace.” … “Economic theory, therefore, leads to unique predictions regarding the types of selection that characterize immigrant flows, the adaptation or assimilation experienced by different immigrants and the impact of these immigrants on the host country” (Borjas, 1989: 461, 482).

The neoclassical perspective on economically-motivated international migration assumes that the utility maximising oeconomicos evaluate potential locations across the global activity space, which is physically and institutionally segmented into nation-states (jurisdictions). This segmentation creates impediments restricting agents’ entry, exit, work and settlement opportunities and imposes the associated mobility costs. The global activity space is also heterogeneous in that national jurisdictions differ in their attributes and attractiveness to different oeconomic hominum. In this highly heterogeneous environment, an agent currently residing at a particular base location may scan and evaluate other accessible locations to determine net benefits of moving there (options to migrate) relatively to the attractor value of their current location (option to remain). They should then choose the option that maximizes their well-being given their resource endowments, which largely determine the desirability and spatial reach of potential relocation and institutional constraints, which determine the feasibility of moving to different destinations. Migration is, thus, a means to an end (a secondary or a derived activity): an enabling investment in spatial mobility needed to move to more attractive, accessible locations.

The Sjaastad cost-benefit model

In an early application of the neoclassical paradigm, Sjaastad (1962) adopted the human capital model to show how economic agents may engage in welfare-enhancing activities at alternative locations by identifying options to migrate/remain and assessing potential destinations in terms of relative returns to the available human capital; controlling for the cost of spatial mobility and impediments restricting free factor movements between jurisdictions (Bodvarsson and Van den Berg, 2009: 27).6

We present Sjaastad’s approach as a simple, formal cost-benefit model in which economic agents are endowed with quanta of human capital and calculate returns available at different accessible destinations relative to the rate of return obtainable at the base location net of transaction costs of spatial relocation. Under conditions of perfect knowledge, the rational oeconomicos select their preferred destination as the one that offers the largest net present value of their lifetime earnings from the use of their human capital endowments. If a particular destination offers more ‘value’ than that provided by the base location, the agent may opt to migrate to take advantage of the apparent opportunity.

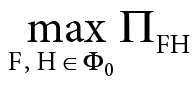

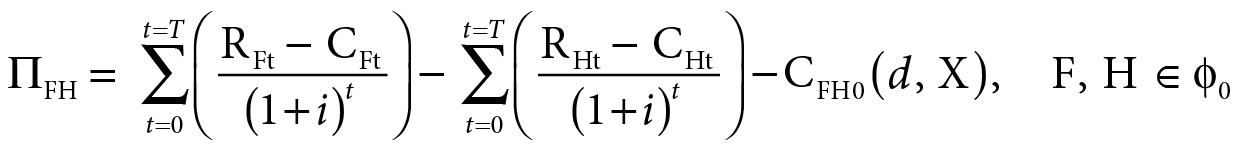

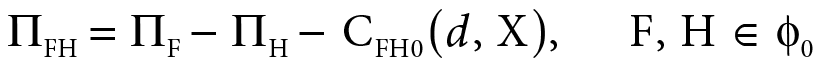

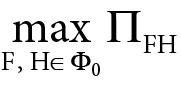

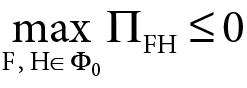

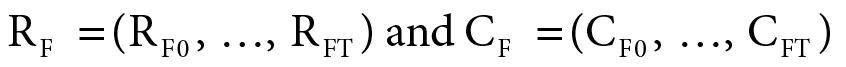

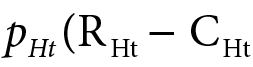

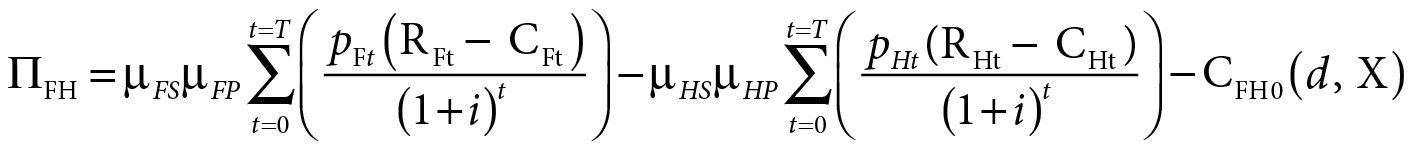

The simple deterministic model is explicitly concerned with a ‘single-shot’ migration opportunity, whereby an oeconomico engages in pairwise comparisons of potential locations for their capital endowment. The anticipated gains from moving the capital from its home/base location, H, to a potential host (foreign) destination, F, must exceed the costs of the move. In each pairwise comparison, the agent calculates the net present value of operating at H and F (ΠH and ΠF) to determine the net gain of relocation from H to F, ΠFH. A similar calculation is performed for each destination F belonging to  , which is a set of all potential host destinations assessed at time t = 0. The wealth maximising agent selects the best prospect of return on their capital endowment,

, which is a set of all potential host destinations assessed at time t = 0. The wealth maximising agent selects the best prospect of return on their capital endowment, .

.

(1)

(1)

, (2)

, (2)

where t stretches from t = 0 to t = T and t = 1, 2,…T. Returns on capital realised, at time t, at the host location F and at the home location H are RFt and RHt, respectively.7 The agent’s time preference rate is i and 1/(1+i)t is the associated discount factor. Similarly, CFt and CHt are the costs (of capital use) at locations F and H at time t (e.g. this could be interpreted as the location-specific cost of living). The cost of migrating from H to F at time t = 0 is shown as CFH0(d, X). It increases with d: the distance between F and H; and with X a vector of other impedance factors. The difference in returns to be realised by migrating from H to F may also be zero or negative. The utility maximising agent would use the cost-benefit equation (1) to short-list all destinations which offer positive prospects of wealth gain, ΠFH ≥ 0, to select the best wealth-enhancing opportunity and, thus, the preferred destination  . If this option to move is exercised, the oeconomico morphs into the homo migrantes. On the other hand, if the best available option offers no net gain from relocating their human capital,

. If this option to move is exercised, the oeconomico morphs into the homo migrantes. On the other hand, if the best available option offers no net gain from relocating their human capital,  , the agent opts to remain at H.

, the agent opts to remain at H.

In the model, the oeconomicos consider four dimensions of potential locations for their human capital endowment:

•the spatial dispersion of rates of return to human capital across different accessible destinations;

•the spatial dispersion of costs of using that capital at different destinations;

•the time profile of economic returns, Rt, and costs, Ct, at each location, which need to be discounted to a particular base date (say t=0) using the appropriate discount factor (1/(1+i)t) and summed up over the activity’s lifespan of T time periods; and

•their rate of time preference (time value of human capital), i.

As the oeconomicos differ in their individual characteristics and capital endowments, variables included in the model may be aggregated differently by different people. Also, the oeconomicos may include different factors in their assessments of mobility/immobility prospects. Thus, to assert how particular agents actually assess their mobility options we would need agent-specific information on their choice of decision variables, the associated physical quantities, imputed values (actual or shadow prices) and the basis of agent-specific aggregation. In effect, the relative attractiveness of different locations is refracted through individual characteristics and preferences of different agents.

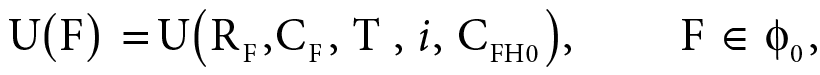

The pecuniary cost-benefit model can also be re-specified to compare utilities assigned to different locations by the decision-maker:

(3)

(3)

where  . The U (F) is the representative agent’s non-decreasing and quasi-concave utility function and the agents choose to move to a location that maximizes their utility. The foreign location is at a disadvantage since the cost of moving rarely equals zero for locations other than home:

. The U (F) is the representative agent’s non-decreasing and quasi-concave utility function and the agents choose to move to a location that maximizes their utility. The foreign location is at a disadvantage since the cost of moving rarely equals zero for locations other than home:

. (4)

. (4)

The agent’s utility perspective makes the model more general and flexible, allowing it to incorporate additional decisional dimensions and cost-benefit values. However, as this gain in flexibility is partially offset by less precise predictions, we have included the more specific Sjasstad-style model (1) together with the more general, utility optimising representation (3).

Uncertainty and expected utility

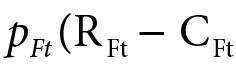

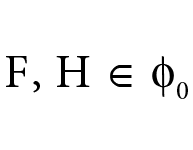

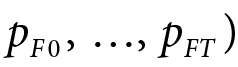

Several writers have refined Sjastaad’s model by introducing probabilities of alternative cost-benefit scenarios (see in particular Todaro 1969; Harris and Todaro 1970; Corden and Findlay 1975). Let pFt denote the probability of realising the net returns to human capital at time t at location F and pHt at location H. Thus,  ) and

) and  ) are the expected net returns to human capital at F and H, respectively, at time t and the difference between location-specific expected streams of returns is the expected net gain from moving the quantum of human capital from H to F. The oeconomico will only become the homo migrantes if the expected net gain from exercising an option to move from the current home location H to the best alternative destination F is positive:

) are the expected net returns to human capital at F and H, respectively, at time t and the difference between location-specific expected streams of returns is the expected net gain from moving the quantum of human capital from H to F. The oeconomico will only become the homo migrantes if the expected net gain from exercising an option to move from the current home location H to the best alternative destination F is positive:

(5)

(5)

This approach could be further refined by taking into consideration job search costs, periods of un- or under-employment of human capital at different locations, random match effects, planned return migration, and so on. All such cost items could be assigned particular probabilities of their occurrence, as above, or more generally as random variables that have different possible outcomes.

Probabilities of different returns on capital at different locations may also be incorporated into the more general utility model to take into account agents’ different attitudes to risk and methods of aggregation:

(6)

(6)

where pF is the vector ( . In general, the attributes of home location have significant bearing on the agent’s choices. For example, people located at ‘home’,

. In general, the attributes of home location have significant bearing on the agent’s choices. For example, people located at ‘home’,  , are often much better informed about returns to their human capital and the associated risks at that location. Also, those who have no appetite for risky re-locations are more likely to remain in situ. It is, therefore, likely that people’s locational preferences are path-dependent. The basic model of the representative agent’s spatial mobility-immobility choices ignores such autoregressive aspects of decision making. Additionally, exercising an option to migrate is treated implicitly as a single shot decision, i.e., at the decision time t=0 the agents consider streams of benefits and costs over timeframe [0, T] but they only migrate once, although this could be an intended temporary migration (as discussed by Dustmann and Görlach 2016).

, are often much better informed about returns to their human capital and the associated risks at that location. Also, those who have no appetite for risky re-locations are more likely to remain in situ. It is, therefore, likely that people’s locational preferences are path-dependent. The basic model of the representative agent’s spatial mobility-immobility choices ignores such autoregressive aspects of decision making. Additionally, exercising an option to migrate is treated implicitly as a single shot decision, i.e., at the decision time t=0 the agents consider streams of benefits and costs over timeframe [0, T] but they only migrate once, although this could be an intended temporary migration (as discussed by Dustmann and Görlach 2016).

Polachek and Horvath (2012) modified the single-shot migration model of Sjaastad to represent migration as an outcome of the continuous investment process stretching over the entire life cycle of the perspicacious peregrinator who periodically evaluates the attractiveness of different locations in terms of economic conditions (employment prospects, industrial structures, wage and price levels) and access to public goods and amenities. Thus, economic agents remain perennially footloose and could move repeatedly if and when new locations become more attractive (see also a model of sequential in-country migrations driven by expected income differentials in different locations in Kennan and Walker, 2011). Pickles and Rogerson (1984) and McCall and McCall (1987) have explored the concept of periodic and chain-like migration decisions where the net income maximising migrant evaluates different destinations periodically to move to a higher value location. Hatton and Williamson (2005) and Clark, Hatton and Williamson (2007) have focused more specifically on the cost of moving migrant human capital.

Borjas (1987, 1989, 1991, 1994) extended Sjaastad’s model as well as that of Harris and Todaro (1970) to broaden the concept of expected income differentials between locations. In his model, human capital investors must consider the expected income streams, net of migration costs, at different potential destinations and factor in the likely depreciation (or appreciation) of their human capital endowments (such as the transferability of their skills or educational attainments) as they move across borders. That is demands for different skills vary between locations and the value of skills may appreciate or depreciate as people move between jurisdictions. For any given human capital endowment, opportunities for realising its potential also differ between destinations and some of these differences could be attributed to observable characteristics of these areas (e.g., differences in average earnings or different earning distributions), while others are influenced by attributes that are not directly observable (e.g., chance factors that determine who does well and who does poorly at each location). Thus, mobility decisions and the selectivity of migrant flows depend on how different components of human capital are expected to appreciate/depreciate as migrants cross borders, that is, on the inherent spatial transferability of human capital and on the oeconomico’s appetite for risk (see also Massey et al., 1993, 2008). Dustmann and Görlach (2016) provide a comprehensive framework for analysing temporariness in the spatial reallocation of human capital, which endogenizes the duration of stay at different locations and, thus, allows for intended and unintended temporary/return migrations, seasonal, repeat and circulatory mobility, and so on.

Finally, in our individual decision-making framework, it is assumed implicitly that the agent is endowed with a quantum of human capital that is used as a fixed quantity irrespective of where it is deployed. This assumption of capital lumpiness needs to be revisited as the location-specific return per unit of capital may influence how much of it is used at any given location. We revisit this problem in the following section.

Collective decision making

New Economics of Labour Migration

Building on the earlier work of Becker (1974, 1975), Polachek and Horvath (2012) and Mincer (1978), sophisticated models of collective decision-making have been developed by the New Economics of Labour Migration (NELM) (Stark and Bloom, 1985; Stark, 1991) to facilitate more realistic representations of migration-related decision processes that incorporate collective decisions by households, extended families, clans, or local communities. For example, a family may club together to pay for the education of its potentially mobile members to increase their human capital endowments and to assist them in moving to higher-income destinations. This collective investment may be subsequently ‘repaid’ when a sponsored individual remits part of their income or acts as a sponsor for other family members (Stark, 2009). Thus, migration of some family members combined with migrant remittances may provide a means of family income and consumption smoothing and risk management (Stark and Levhari, 1982; Rosenzweig, 1988; Rosenzweig and Stark, 1989; Chen and Chiang, 1998; Foster and Rosenzweig, 2001; Cox and Jimenez, 1992; Cox et al., 1998; Poirine, 1997).

The NELM framework can also be used to model a wide range of relationships between members of families and the associated intra- and inter-generational transfers of capital assets within various collective entities. Migrant earnings may be remitted back home to assist those left behind, to acquire assets such as land and property, secure the remitter’s preferential claim on family inheritance, arrange an advantageous marriage, or climb the seniority ladder in the home community (Massey et al., 2008). The collective decision paradigm shifts the institutional emphasis from market-mediated to non-market allocative processes, i.e. those that take place within families or communities.8 These non-market transactions are based on incomplete, quasi-contractual arrangements between individuals and their families or communities and, thus, they rely on informal contract enforcement mechanisms the effectiveness of which depends on prevailing social norms, opportunities for social exclusion, or the threat of ostracism.

The NELM approach also allows the collectively-owned wealth to be represented as portfolios of assets jointly owned and managed by family members. Thus, a family may engage in portfolio diversification to mitigate risks posed by excessive dependence on income derived from a particular activity such as traditional subsistence farming. As Rapoport and Docquier (2006: 1150) note, “in a context of imperfect capital markets, remittances may be part of an implicit migration contract between the migrant and his or her family, allowing the familial entity to access to higher and/or less volatile incomes”.9 Similarly, expatriate members of the collective may also return home to mitigate risks of various adversities and to take advantage of the intra-family welfare support. Thus, the diversification of family capital assets through migration becomes a quasi-contractual mechanism of risk mitigation to be used when markets are imperfect or absent and where mechanisms of social/welfare support do not allow for market-mediated risk transfers and hedging (Stark, 1991, 2009; Dustmann, 1997; De Jong et al., 1996; De Jong, 2000).

Collective decision-making framework

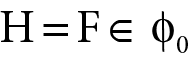

Providing that the collective capital management decision involves consideration of repositioning a quantum of human capital between the initial home location, H, and a potential destination, F, the cost-benefit evaluation equation (5) may be used by the collective entity as a decision support tool if the size of a collective entity and the rules governing the distribution of returns remain invariant regardless of where that capital is used. Similarly, the canonical utility equation (6) may also be used when the collective entity maximises its joint utility in a manner similar to a natural individual maximising their total utility.

However, since the spatial repositioning of a quantum of human capital by the collective entity may also involve the spatial repositioning of a person(s) in whom that capital is embedded, the collective entity should not mimic individual total utility maximisers. Members may increase or decrease their utility by sharing locations with other community members. Additionally, in most collective entities, individual members are free to leave the collective, taking their human capital with them and new members may be allowed to join the collective. Thus, considerations of the group size and governance arrangements, which determine the nature of mutual dependency between its members, are critical in determining the spatial allocation of the entity’s human capital and, thus, the spatial mobility-immobility of its membership.10 In particular, it is important to ascertain whether the membership of the collective entity and member rights and obligations change when it decides to spatially reposition some of its human capital. Similarly, it is important to ascertain who the principals and agents of these decisions are, what quasi-contractual terms are agreed by the parties to govern capital-cum-member relocation, and what mechanisms could be used to enforce such quasi-contracts if necessary. The NELM is often ambiguous about the impact of the spatial mobility-immobility of members of collective entities on the latter’s size, structure and terms of governance.11

The diversity of capital assets, value expectancy and migration intentions

Social and public capital

To date, the two most influential areas of social science concerned with people’s mobility and immobility have been economics and sociology. The neoclassical economics approach to migration has often been criticised for its oversight of non-economic factors, which are likely to influence people’s mobility decisions (Arango, 2000: 287). While the economic literature has emphasised differentials in income and earnings, movement costs, and jurisdictional entry barriers as drivers or impedants of human capital mobility, the sociological literature has focused on the role of expectations, social trust, reciprocity motives and incentives in mobility decisions (Bourdieu, 1986 and 2006; Coleman, 1990; Harbison, 1981; Sanders and Nee, 1996; De Jong, 2000; Vallejo and Keister, 2019).12 The two perspectives differ in one notable respect. The strictly economic approach is ultimately concerned with the mechanics, efficiency and effectiveness of resource allocation and uses, i.e. the process of wealth creation. The sociological approach is mostly focused on how this wealth is utilised to achieve various social objectives in the formation and sustainment of different social structures and in the conduct of human affairs generally.

By and large, the extant economic literature has shown limited interest in the diversity of capital forms, which could be used to explain human spatial mobility and immobility. A notable exception is the literature focused on social capital as a complementary resource enhancing the value of human capital endowments.13 This draws on the embeddedness approach in economic sociology: family and kinship ties make it easier to realise the potential inherent in people’s human capital endowments as they enhance the range of employment and social opportunities, including migration, and increase the likelihood of effective capital utilisation (Haug, 2008).14 Similar benefits may be realised through access to social networks (complementary social capital) accessible at different locations, which facilitate information flows and provide access to employment and residential opportunities, operate as quasi-markets restricted to network members, and as conduits for community welfare support. They are often responsible for chain migration in that the costs and risks associated with people’s mobility decline as successive cohorts follow the lead of early movers (e.g., Da Vanzo, 1981; Taylor, 1986; Massey and García Espana, 1987; Borjas, 1992; Portes, 1995; De Jong et al., 1996). As a result, the migration of people from a particular source jurisdiction or ethnic background becomes cumulative and self-sustained. However, the self-perpetuating (snowballing) dynamics of cumulative migration also depends on whether each new quantum of capital contributed by successive migrants can effectively be added to the existing stock and absorbed at the host location (Harrington, 2005).15

Ultimately, the spatial mobility of the oeconomicos is often influenced by the availability of complementary bundles of goods and services at different destinations, i.e. access to different amenities, public goods and non-tradeables such as law and order and political systems that guarantee specific individual freedoms (Graves, 1983; Roback, 1988; Greenwood, 1997; Shields and Shields, 1989). Thus, public investment in amenities and collective goods may attract economic agents seeking complementary public capital to enhance the value of their individual human capital endowments. As access to such location-specific public capital is financed by taxation, the oeconomico must also factor in the location-specific tax burden. This is the essence of the Tiebout hypothesis, which asserts that jurisdictions compete for settlers differentiating amenity-tax packages and potential residents non-randomly disperse between them as they seek locations that best match their amenity-tax preferences (Tiebout, 1956).

We can now include different forms of capital accessible at different locations net of costs of accessing them by the agent concerned in the cost-benefit equation (5). Again, the representative agent evaluates locations F and H, where F, H ∈ Φ0, to maximize the expected net gain from a potential change of location, taking into consideration additional attributes of attractiveness specific to different destinations:

(7)

(7)

, (8)

, (8)

where the location-specific multipliers reflect the expected availability of net benefits associated with access to social capital, µFS and public capital, µFP, at locations F, H ∈ Φ0, where µΦΚ ≥ 0 and K are different categories of capital so that S, P ∈ Κ. The multipliers may also reflect particular attributes of the oeconomico, for example, some agents are keen on access to social networks or public goods and, thus, they impute higher weightings to locations offering greater availability of their preferred category of capital assets.

When µFΦΚ = 0 the multiplier effect of a particular category of location-specific capital K is expected to be nil, making the location unattractive. When 0 < µΦΚ < 1, the multiplier concerned has a wealth depleting effect, for example, access to social capital such as ethnic networks may, in the long run, decrease the agent’s ability to make effective use of their human capital. Similarly, access to certain public goods may be ‘addictive’ and impact negatively on the agent’s long-run ability to make good use of their human capital endowments. Also, certain types of cultural capital may produce negative, wealth diminishing ‘lock-in’ effects in the long run. Positive multiplier effects occur when 1 < µΦΚ. When  the agent may move to location FmaxΠ otherwise they would remain at H.

the agent may move to location FmaxΠ otherwise they would remain at H.

Value expectancy, asset portfolios and migration intentions

Thus far, we have largely focused on human capital assets, as migration of people is strictly complementary to the spatial mobility of their human capital. Other forms of capital have been limited to social and public capital endowments specific to different locations that are formed by host communities and may benefit those who move there. However, there are also assets that can be privately acquired and owned by the oeconomico. The two most obvious categories of such assets are physical capital (e.g., real estate, chattels) and financial capital (e.g., cash, bank deposits, and shares). In contrast to human capital, these assets need not move across the activity space together with their owners. Some are spatially immobile (e.g., real estate) but can be owned remotely by spatially mobile oeconomicos, others (e.g. financial capital assets) are portable and can be relocated between jurisdictions with or independently of their owners. Ceteris paribus, individuals who accumulate relatively liquid and portable forms of capital are likely to be more footloose than those encumbered by the ownership of physically immobile assets that require owners’ direct involvement.

An attempt to consolidate considerations of human, social and other forms of capital into an integrated decision model was made by De Jong and Gardner (1981) and De Jong and Fawcett (1981). Their (rational) value expectancy (VE) approach to migration intentions is a variant of the expected value model in which the oeconomico evaluates the relative attractiveness of alternative destinations, including their current place of residence, “in terms of the individually valued goals that might be met by moving (or staying) and the perceived linkage, in terms of expectancy, between migration behaviour and the attainment of these goals in alternative locations including the current place of residence” (De Jong et al., 1983: 473). In this approach, oeconomicos maximise the sum of expected utilities for each accessible location over several decisional dimensions such as wealth, status, comfort, autonomy, and affiliation (Haug, 2008). The value attributed to each dimension is determined by (subjective) individual characteristics of the decision maker, social and cultural norms, personality factors such as adaptability or risk preferences, and the structure of available opportunities. The agent selects the preferred or intended destination as the one that offers the highest expected locational value. Thus, the “decision making theory is explicitly directed toward explaining migration intentions as an intermediate step to actual behaviour” (De Jong et al. 1983: 471).

The parallels between the VE approach and the methodology used in the economic cost-benefit analysis (CBA) are apparent and much of the criticism that has been directed at the latter may also apply to the VE approach. Similar problems arise when the conventional portfolio-theoretic (PT) approach is adopted to determine both the preferred asset-structure of the oeconomico’s portfolio and the preferred location of different assets comprising it, particularly the location of the agent’s human capital.16 The PT approach has been used by the NELM (see Stark, 1991, 2009; Dustmann, 1997). However, the use of such models to determine human migration intentions is rather difficult, given the complexity of asset ownership and location and the often-obscure decision-making structures. Moreover, like many other portfolio-theoretic approaches, the application of PT methodology to determine human migration decisions often ignores “the important qualitative and quantitative implications of the interaction between irreversibility, uncertainty and the choice of timing” in resource allocation decisions (Dixit and Pindyck, 1994: 6). In this respect, Dustmann and Görlach (2016) are a notable exception.

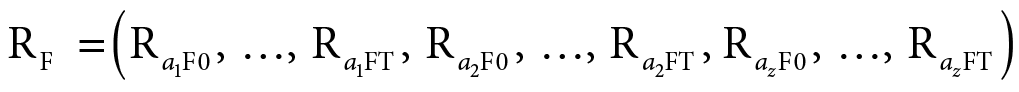

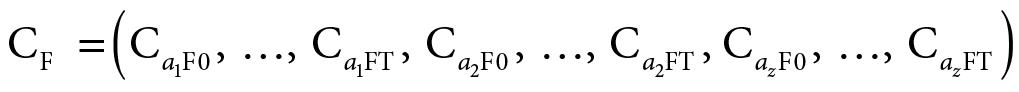

Nevertheless, the VE approach offers a framework for the assessment of changes in the expected value of an oeconomico’s portfolio of assets associated with the contemplated move from their current residence, H, to another location, F. Generally, an agent’s migration decision should be predicated on the expected distribution of all gains and losses from the spatial relocation of the asset owner and the associated relocation and revaluation of all assets comprising the owner’s portfolio (Da Vanzo, 1981; Haug, 2008). This is implicit in our cost-benefit equation (7), which we now revisit to re-specify benefit and cost vectors, RF and CF, by incorporating in the oeconomico’s portfolio a vector of capital assets, a2 to az, as well as the agent’s human capital, a1. Thus,

The general shape of utility function appears to be unchanged, although the benefit and cost vectors have been assigned a different interpretation:

(9)

(9)

In practice, this multitude of decisional dimensions, and the associated trade-offs may present insurmountable problems for any real-life decision taker.17 Both the VE approach and the PT methodology have shown that the development of complex, formal models to determine human relocation intentions may be very difficult, time-consuming and prohibitively costly. To use such methodologies, the oeconomicos would have to determine their own resource endowments within the stipulated time horizon, the attendant states of the world that might affect the use of these resources and, in this context, define their economic strategies and intentions including the potential for spatial relocation of their human capital and other portable components of their wealth. As Kogut and Kulatilaka (2001: 745) observe, “The dimensional problem of identifying all these elements and understanding their interactions quickly defies a declarative analysis (i.e. net present value) or an exhaustive procedural search across all combinations”. Moreover, if the investment experience of business firms is to be drawn on, it is often doubtful that the application of sophisticated analytic methods produces significantly better investment and locational outcomes than back-of-the-envelope calculations and intuitive problem-solving (Bowman, 1963). The vast majority of people faced with such choices “must simplify complexity in the face of uncertainty” (Williams and Baláž, 2011: 170) by applying heuristics or relying on hunches and imitative behaviour.

Optionalising migration intentions

Normally, a rational response to informational voids and asymmetries is to avoid the premature declaration of intended future activity and postpone both the declaration and its implementation until the most likely state of the world becomes more apparent. Thus, the intention to relocate resources and to migrate may be deferred until such time when more accurate information becomes available and the true characteristics of different destinations and activities are revealed. Consequently, a decision to migrate or to remain in situ may be framed as a string of real options related to particular states of the world and restricted to specific timeframes, and only exercised if and when opportune conditions materialise. Otherwise, each option would be allowed to lapse.

This evolving decision-making approach may sometimes take several steps and a sequence of options: at each step, as more information becomes available, the corresponding mobility option is either exercised or allowed to lapse. Each step, however, may also require a resource outlay to explore the evolving problem-solution spaces. Thus, it has to be determined at each step if the value of flexibility offered by the next option justifies its cost. Flexibility comes at a price and options must be ‘purchased’ so that an option’s cost has to be offset by the expected benefit of loss avoidance.18 In addition, the momentum of resource allocation may sometimes be lost when an early commitment to action is postponed. Nevertheless, the expected value of regrets from taking a wrong decision prematurely often far outweighs the cost of postponement.

The real options approach, defined as “the investment in physical and human assets that provides the opportunity to respond to future contingent events” (Kogut and Kulatilaka, 2001: 745), allows the oeconomico to “proactively exploit risk rather than just absorb it” (ibid). It offers an intuitively attractive way of modelling the cautious behaviour of risk-averse economic agents.19 However, to be able to apply the real options methodology the oeconomico must be able to identify the source of uncertainty as well as retain their decision-making discretion to exercise valuable options at the appropriate time and let other options lapse. Thus, their investment choices must also involve sunk (irretrievable) cost components described by Kogut and Kulatilaka as ‘irreversibility’ (or the ‘arrow of time’), i.e. an option has value only if knowledge is limited and investment decisions, such as spatial mobility of resources, cannot be reversed costlessly.

In the migration literature, the real options approach has been pioneered by Burda (1993 and 1995) who showed that the value of postponement (an option to move to be exercised at a later date) could be a function of the expected (real) income gap between home and target destination as well as the expected cost of the contemplated move. In a more recent application of the real options approach, Roberts and Morris (2003) showed how an option to migrate could reduce the variance (risk) of the overall household income. Tabor (2010) shows that people often segment their migration decisions into stages (i.e. pre-contemplation, contemplation, action, acculturation) and simplify complexities into yes/no decision frameworks. This is another way of optionalising the spatial allocation of resources, although it differs from the real options approach in that the options are not precisely valued.

Clearly, the use of rigorous option valuation methodology would present overwhelming technical challenges for a vast majority of people. Nevertheless, there is value to be realised by following an intuitive, step-by-step approach in most resource allocation decisions. But even the intuitive approach requires the agent concerned to be ready to make an initial effort to understand the source of uncertainty, thus, what might be gained by postponing the final decision and by making stepwise decisions contingent on particular states of the world being revealed. They must also be sufficiently confident in their capacity to exercise or reject an option at each decision point. Only in such a case the ‘buying’ of a real option makes sense. However, a strongly risk-averse individual may also be averse to invest in learning and postponement, since it is also lost if the idea to migrate is abandoned. That is many people are likely to be averse to taking any risky opportunities to move or to change the status quo, regardless of whether it is a one-shot choice or a sequence of decision steps requiring a small initial investment. Such attitudes may have a cumulative effect on the preference to stay. On the other hand, even risk-averse individuals may move when others move and the bandwagon is large enough to jump on it or when circumstances beyond their control force them to relocate.

***

At the outset of this paper, we asked why, notwithstanding the current publicity surrendering international migration, only a relatively small proportion of the global population has actually migrated between countries. The predictable response has been that it was the border controls that have prevented mass migrations. But this is only part of the explanation. In economically diverse regions such as the EU, accession of new member states have been followed by migration surges. But once the post-accession dust has settled, the long-term rate of relocation declines and stabilises, as factors other than income/wealth differentials come into play. Over the past two decades, migration studies have made considerable progress towards enhanced understanding of the complexity of migration processes and the multitude of factors that influence people’s spatial mobility, immobility and settlement behaviour. However, much of this enhanced understanding has been fragmented between multiple theories separated from each other by their specialist focus and disciplinary silos. This paper attempts to provide an eclectic, meta-theoretical perspective on economic drivers of international mobility and immobility of human capital and, thus, spatial choices of people in whom this capital is embedded. These issues have been addressed by economists over a long period of time (for a discussion of issues concerned see, for example, Castles, 2010 and 2013) but the associated literature is still fragmented and often too technical for non-specialists to follow. In this paper, we have attempted to bring some strands of the extant literature together to highlight the sheer complexity of migration-related decision-making resulting, inter alia, from diverse and hard-to-assess characteristics of potential destinations, the inter-temporal dimension of such locational choices, informational asymmetries, and the frequent involvement of many individuals (e.g., family members, communities) in collective decision making processes. In particular, we have been particularly interested in choices that require individuals or groups to take into consideration the characteristics of different capital assets as components of their individual or collective wealth, and the impact of their spatial mobility on the location and valuation of these assets. We draw on the neoclassical foundations of the economics discipline as “central to building strong and coherent theories (of human behaviour) … to maintaining the desirable level of normative awareness … and … for consensus-building and adjudication and are at the heart of most progress and innovation within the discipline” (Cornut, 2015: 63). Our eclectic approach aims to provide an overarching framework to link and integrate more specific and narrowly focused theories explaining economic causes of international location of the human capital.

We have also aimed to show that along the centrifugal forces that disperse people between countries, such as income differentials or access to location-specific public goods, there are also strong centripetal forces which encourage people to remain in situ. The latter have received relatively less attention in the economic literature but there are many reasons why many people who are otherwise concerned with their economic wellbeing, may prefer to remain in their homeland despite the apparent presence of income/wealth differentials between their home location and other accessible destinations. These reasons include sentimental, family and social attachments that bond people together and make them wish to stay in close proximity to each other. They also include the expected changes in the composition and valuation of their wealth so that, for example, welfare gains associated with access to better job opportunities elsewhere may be more than offset by the expected welfare loss from the devaluation of their accumulated stock of assets (e.g., loss of inheritance) or the restricted access to public goods available at the home location (e.g., welfare assistance, health care, education). In terms of the decision-making model outlined above, they opt to stay put because the value of their capital endowments at the home location exceeds the expected net value of capital assets to be realised elsewhere. We have added one further reason for immobility, which relates to the complexity and uncertainty inherent in human decisions to relocate across national borders. To simplify the complexity of such choices people often apply heuristics or imitate other people’s behaviour. Alternatively, they may ‘optionalise’ their decision-making processes to make them step-wise and contingent on relevant information being revealed progressively: the real options approach. For some people, however, the natural default position, when confronted with complex decisions with risky outcomes and costly implications, is to avoid them altogether by opting for the status quo.

The expected utility formulation of the decision problem outlined in this paper helps to identify the many dimensions that may come into play in people’s relocation decisions. However, to explain specific, locational preferences and choices made by particular people in particular circumstances, especially those who have not moved from their base location, specific theories must be advanced that tailor the above eclectic methodology to produce subsets of specific, testable hypotheses. In particular, it remains to be tested empirically whether the observed immobility of most people reflects their considered preference to remain in their homeland as the best of available options, or the lack of opportunity to move elsewhere, or a default position to remain in situ when spatial relocation choices are too complex and risky to make.

Bibliography

Arango, J. (2000). Explaining Migration: A Critical View. International Social Science Journal, 52 (165): 283–96.

Barth, J., Kraft, J. Wiest, P. (1975). A Portfolio Theoretic Approach to Industrial Diversification and Regional Employment. Journal of Regional Science, 15 (1): 9–15.

Becker, G. (1974). A Theory of Social Interaction. Journal of Political Economy, 82.

Becker, G. (1975). Human Capital. 2nd ed. Chicago: Chicago University Press.

Bodvarsson, Ö. B., Van den Berg, H. (2009). The Economics of Immigration: Theory and Policy. 2nd ed. Berlin: Springer-Verlag.

Borjas, G. J. (1992). Ethnic Capital and Intergenerational Mobility. The Quarterly Journal of Economics, 107 (1): 123–50.

Borjas, G. J. (1989). Economic Theory and International Migration. The International Migration Review, 23 (3): 457–485.

Borjas, G. J. (2015). Immigration and Globalization: A Review Essay. Journal of Economic Literature, 53 (4): 961–974.

Borjas, G. J. (1987). Self-Selection and Earnings of Immigrants. American Economic Review, 77 (4): 531–553.

Borjas, G. J. (1991). Immigration and Self-Selection. In: Immigration, Trade and the Labour Market. J. Abowd, R. Freeman (Eds.). Chicago: University of Chicago Press.

Borjas, G. J. (1994). The Economics of Immigration. Journal of Economic Literature, 32 (4).

Bourdieu, P. (2006). The Forms of Capital. In: Education, Globalisation and Social Change. H. Lauder, P. Brown, J. A. Dollabough, A. H. Halsey (Eds.). Oxford: Oxford University Press: 105–119.

Bourdieu, P. (2006). The Forms of Capital. In: Handbook of Theory and Research for the Sociology of Education. J. G. Richardson (Ed.). New York: Greenwood.

Bourdieu, P. (1985). Social Space and the Genesis of Groups. Theory and Society, 16 (6).

Bourdieu, P., Wacquant, L. J. D. (1992). An Invitation to Reflexive Sociology. Cambridge: Polity.

Bowman, E. H. (1963). Consistency and Optimality in Managerial Decision Making. Management Science, 9.

Bowman, E. H., Moskowitz, G. T. (2001). Real Options Analysis and Strategic Decision Making. Organization Science, 12 (6).

Boxman, E. A. W., De Graaf, P. M., Flap, H. D. (1991). The Impact of Social and Human Capital on the Income Attainment of Dutch Managers. Social Networks, 13: 51–73.

Buchanan, J. M. (1965). An Economic Theory of Clubs. Economica, 32 (125): 1.

Burda, M. C. (1993). The Determinants of East-West German Migration. European Economic Review, 37.

Burda, M. C. (1995). Migration and the Option Value of Waiting. Economic and Social Review, 27 (1): 1–19.

Castles, S. (2010). Understanding Global Migration: A Social Transformation Perspective. Journal of Ethnic and Migration Studies, 36 (10): 1565–1586.

Castles, S. (2013). The Forces Driving Global Migration. Journal of Intercultural Studies, 34 (2): 122–140.

Chandra, S. (2002). A Test of the Regional Growth-Instability Frontier Using State Data. Land Economics, 78 (3): 442–62.

Chandra, S. (2003). Regional Economy Size and the Growth-Instability Frontier: Evidence from Europe. Journal of Regional Science, 43 (1): 95–122.

Chandra, S., Shadel W. G. (2007). Crossing Disciplinary Boundaries: Applying Financial Portfolio Theory to Model the Organization of the Self-Concept. Journal of Research in Personality, 41 (2): 346–73.

Chen, K. P., Chiang, S. H. (1998). Migration as Portfolio Selection. York: Mimeo.

Clark, X., Hatton, T. J., Williamson, J. G. (2007). Explaining U. S. Immigration, 1971–1998. Review of Economics and Statistics, 89 (2): 359–73.

Clemens, M. A. (2011). Economics and Emigration: Trillion-Dollar Bills on the Sidewalk? Journal of Economic Perspectives, 25 (3): 83–106.

Coleman, J. S. (1990). The Foundations of Social Theory. Cambridge, MA: Belknap of Harvard UP.

Conroy, M. (1975). Regional Economic Diversification. New York: Praeger.

Constant, A. F., Zimmermann, K. F. (2013). International Handbook on the Economics of Migration. Edward Elgar Publishing.

Corden, W. M., Findlay, R. (1975). Urban Unemployment, Intersectoral Capital Mobility and Development Policy. Economica, 42 (165): 59–78.

Cornut, J. (2015). Analytic Eclecticism in Practice: A Method for Combining International Relations Theories. International Studies Perspectives, 16 (1): 50–66.

Cox, D., Eser, Z., Jimenez, E. (1998). Motives for Private Transfers over the Life Cycle: An Analytical Framework and Evidence for Peru. Journal of Development Economics, 55 (1): 57–80.

Cox, D., Jimenez, E. (1992). Social Security and Private Transfers in Developing Countries: The Case of Peru. World Bank Economic Review, 6 (1): 155–69.

Da Vanzo, J. S. (1981). Microeconomic Approaches to Studying Migration Decisions. In: Migration Decision Making: Multidisciplinary Approaches to Microlevel Studies in Developed and Developing Countries. G. F. De Jong, R. W. Gardner (Eds.). New York: Pergamon Press.

Dasgupta, P. (1990). Well-Being and the Extent of Its Realisation in Poor Countries. The Economic Journal, 100 (400): 1–32.

De Jong, G. F., Abad, R. G., Arnold, F., Carino, B. V., Fawcett, J. T. (1983). International and Internal Migration Decision Making: A Value-Expectancy Based Analytical Framework of Intentions to Move from a Rural Philippine Province. International Migration Review, 17 (3).

De Jong, G. F., Fawcett, J. T. (1981). Motivations for Migration: An Assessment and a Value-Expectancy Research Model. In Migration Decision Making: Multidisciplinary Approaches to Microlevel Studies in Developed and Developing Countries. New York: Pergamon Press.

De Jong, G. F., Johnson. A. G., Richter. K. (1996). Determinants of Migration Values and Expectations in Rural Thailand. Asian and Pacific Migration Journal, 5 (4): 399–416.

De Jong, G. F. (2000). Expectations, Gender and Norms in Migration Decision Making. Population Studies, 54 (3): 307–19.

De Jong, G. F., Gardner. R. W. (Eds.) (1981). Migration Decision Making. Multidisciplinary Approaches to Microlevel Studies in Developed and Developing Countries. New York: Pergamon Press.

Dixit, A., Pindyck, S. (1994). Investment Under Uncertainty. Princeton: Princeton University Press.

Dustmann, C. (1997). Return Migration, Uncertainty and Precautionary Savings. Journal of Development Economics, 52 (2): 295–316.

Dustmann, C. Görlach, J.-S. (2016). The Economics of Temporary Migrations. Journal of Economic Literature, 54 (1): 98–136.

Elton, E. J., Gruber, M. J. (1997). Modern Portfolio Theory, 1950 to Date. Journal of Banking and Finance.

Foster, A. D., Rosenzweig, M. R. (2001). Imperfect Commitment, Altruism, and the Family: Evidence from Transfer Behavior in Low-Income Rural Areas. Review of Economics and Statistics, 83 (3): 389–407.

Graves, P. E. (1983). Migration with a Composite Amenity: The Role of Rents. Journal of Regional Science, 23 (4): 541–46.

Greenwood, M. J. (1997). Internal Migration in Developed Countries. In: Handbook of Population and Family Economics. M. Rosenzweig, O. Stark (Eds.). Amsterdam: Elsevier.

Harbison, S. F. (1981). Family Structure and Family Strategy in Migration Decision Making. In: Migration Decision Making, Multidisciplinary Approaches to Microlevel Studies in Developed and Developing Countries. G. F. De Jong, R. W. Gardner (Eds.). New York: Pergamon Press: 225–51.

Harrington, A. (2005). Modern Social Theory: An Introduction. Oxford: Oxford University Press.

Harris, J., Todaro, M. (1970). Migration, Unemployment and Development: A Two-Sector Analysis. American Economic Review, 60.

Hatton, T. J., Williamson, J. G. (2005). What Fundamentals Drive World Migration? In: Poverty, International Migration and Asylum. G. Borjas, J. Crisp (Eds.). New York: Palgrave Macmillan.

Haug, S. (2008). Migration Networks and Migration Decision-Making. Journal of Ethnic and Migration Studies, 34 (4): 585–605.

Hester, D. D., Tobin, J. (1967). Risk Aversion and Portfolio Choice 19. New York: John Wiley.

Hicks, J. (1932). The Theory of Wages. London: Macmillan.

Inglehart, R. (1997). Modernization and Postmodernization: Cultural, Economic and Political Change in 43 Societies. Princeton: Princeton University Press.

Kennan, J., Walker, J. R. (2011). The Effect of Expected Income on Individual Migration Decisions. Econometrica, 79 (1).

Kogut, B., Kulatilaka, N. (2001). Capabilities as Real Options. Organization Science, 12 (6): 744–58.

Levitt, P. (2007). God Needs No Passport. New York: The New Press.

Levitt, P. (2001). The Transnational Villagers. Berkeley and Los Angeles: University of California Press.

Levitt, P. (1998). Social Remittances: Migration Driven Local-Level Forms of Cultural Diffusion. International Migration Review, 32 (4): 926.

Markowitz, H M. (1959). Portfolio Selection: Efficient Diversification of Investments. New York: John Wiley.

Markowitz, H. M. (1952). Portfolio Selections. Journal of Finance, 7.

Massey, D. S., García España, F. (1987). The Social Process of International Migration. Science, 237: 733–38.

Massey, D., Arango, J., Hugo, G., Kouaouci, A., Pellegrino, A., Taylor, J. E. (2008). Worlds in Motion: Understanding International Migration at the End of the Millennium. Oxford: Clarendon Press.

Massey, D., Arango, J., Hugo, G., Kouaouci, A., Pellegrino A., Taylor, J. E. (1993). Theories of International Migration: A Review and Appraisal. Population and Development Review, 19 (3): 431–66.

McCall, B. P., McCall, J. J. (1987). A Sequential Study of Migration and Job Search. Journal of Labor Economics, 5 (4): 452–76.

Mincer, J. (1978). Family Migration Decisions. Journal of Political Economy, 86 (5): 749–73.

OECD (2017). International Migration Outlook 2017. Paris: OECD Publishing.

OECD (2019). International Migration Outlook 2019. Paris: OECD Publishing.

Olson, M. (1996). Big Bills Left on the Sidewalk: Why Some National Are Rich and Others Poor. Journal of Economic Perspectives, 10 (2): 3–24.

Pickles, A, Rogerson, P. (1984). Wage Distribution and Spatial Preferences in Competitive Job Search and Migration. Regional Science, 18.

Poirine, B. (1997). A Theory of Remittances as an Implicit Family Loan Arrangement. World Development, 25 (4): 589–611.

Polachek, S. W., Horvath, F. W. (2012). A Life Cycle Approach to Migration: Analysis of the Perspicacious Peregrinator. In: Research in Labor Economics (35th Anniversary Retrospective). S. W. Polachek, K. Tatsiramos (Eds.). Emerald Group Publishing Limited: 349–95.

Portes, A. (1995). The Economic Sociology of Immigration. New York: Russell Sage Foundation.

Rapoport, H., Docquier, F. (2006). The Economics of Migrants’ Remittances. In: Handbook of the Economics of Giving, Altruism and Reciprocity. S. C. Kolm, J. M. Ythier (Eds.) Amsterdam: North Holland: 1135–1198.

Roback, J. (1988). Wages, Rents, and Amenities: Differences Among Workers and Regions. Economic Inquiry, 26 (1): 23–41.

Roberts, K. D., Morris, M. D. S. (2003). Fortune, Risk, and Remittances: An Application of Option Theory to Participation in Village-Based Migration Networks. Source: The International Migration Review, 37 (4): 1252–81.

Rosenzweig, M. (1988). Risk, Implicit Contracts and the Family in Rural Areas of Low-Income Countries. Economic Journal, 393 (98).

Rosenzweig, M., Stark, O. (1989). Consumption Smoothing, Migration, and Marriage: Evidence from Rural India. Journal of Political Economy, 97 (4): 905–926.

Sanders, J. M., Nee, V. (1996). Immigrant Self-Employment: The Family as Social Capital and the Value of Human Capital. American Sociological Review, 61 (2).

Sandler, T., Tschirhart, J. T. (1980). The Economic Theory of Clubs: An Evaluation Survey. Journal of Economic Literature, 18 (4).

Sharpe, W. F. (1970). Portfolio Theory and Capital Markets. New York: McGraw-Hill.

Shields, G. M., Shields, M. P. (1989). The Emergence of Migration Theory and a Suggested New Direction. Journal of Economic Surveys, 3 (4): 277–304.

Siegel, P. B., Johnson, T. G., Alwang, J. (1995). A Structural Decomposition of Regional Economic Instability: A Conceptual Framework. Journal of Regional Science, 35.

Simon, H. A. (2008). Rationality, Bounded. In: The New Palgrave Dictionary of Economics. S. N. Durlauf, E. L. Blume (Eds.), 2nd ed. Palgrave Macmillan.

Sjaastad, L. A. (1962). The Costs and Returns of Human Migration. Journal of Political Economy, 70 (5): 80–93.

Solimano, A. (2010). International Migration in the Age of Crisis and Globalization. Cambridge: Cambridge University Press.

Stark, O. (1991). The Migration of Labour. Oxford: Blackwell.

Stark, O. (2009). Reasons for Remitting. World Economics, 10 (3).

Stark, O., Bloom, D. E. (1985). The New Economics of Labour Migration. The American Economic Review, 75.

Stark, O., Levhari, D. (1982). On Migration and Risk in LDCs. In Economic Development and Cultural Change, 31: 191–96.

Tabor, A. S. (2010). A Framework of Voluntary Migration: Understanding Modern British Migration to New Zealand. (Unpublished doctoral thesis) University of Wellington.

Taylor, J. (1986). Differential Migration, Networks, Information and Risk. In: Research in Human Capital and Development. O. Stark (Ed.). Vol. 4. Greenwich CN: JAI Press.

Tiebout, C. (1956). A Pure Theory of Local Expenditures. Journal of Political Economy, 64 (5).

Todaro, M. (1969). A Model of Labour Migration and Urban Unemployment in Less Developed Countries. American Economic Review, 59.

UN (2015). World Population Prospect: The 2015 Revision Key Findings and Advance Tables. New York: United Nations.

UN (2016). International Migration Report 2015: Highlights. New York: United Nations.

Vallejo, J. A., Keister, L. A. (2019). Immigrants and wealth attainment: migration, inequality, and integration. Journal of Ethnic and Migration Studies. DOI: 10.1080/1369183X.2019.1592872

Weintraub, E. R. (2007). Neoclassical Economics. The Concise Encyclopaedia of Economics. http://www.econlib.org/library/Enc1/NeoclassicalEconomics.html

Williams, A. M., Baláž, V. (2011). Migration, Risk, and Uncertainty. Population, Space, Place, 18.

Zimmermann, K. F., Bauer, T. (2002). The Economics of Migration. Edward Elgar Publishing.

1 Post-doctoral Researcher at the Centre of Migration Research, the University of Warsaw, Poland

2 Corresponding author. Professor and Chair of Management at the University of Information Technology and Management, Rzeszow, Poland, Visiting Research Professor at the Centre of Migration Research, the University of Warsaw, Poland; and Visiting Professor at the School of Business, the University of New South Wales, Canberra Campus, Australia

3 As they argue, if ‘billions’ of workers could move from the poor South to the prosperous North the global economic gain could amount to ‘hundreds of trillions of dollars’ (Clemens, 2011). This sentiment was first captured in Mancur Olson’s metaphor of big (trillion-dollar) bills left lying on the global sidewalk ready to be picked up by the world at large if only the Northern policymakers were willing to remove the migration restrictions impeding global wealth creation (Olson, 1996).

4 This is most apparent in the European Union (EU), where the post 2004 new member-state accession from the poorer eastern and south-eastern parts of Europe produced an initial surge in the East-West and South-North migration, which has since subsided even though income/age differentials between different parts of the EU are still substantial (OECD, 2019).

5 See Dasgupta (1990) for a deep discussion of the concept of utility maximisation.

6 Some scholars, e.g. Becker (1975), view migration not only as a means of realising different returns on a particular quantum of human capital but also as an enabling investment allowing the oeconomicos to enhance their amount of human capital through subsequent location-specific education, training or health care, as these capital enhancement opportunities are distributed differently across activity space.

7 In a simple case, the gross return on human capital can be envisaged as a wage income over the lifetime of residence at a particular location.

8 Market imperfections or the absence of mature capital and insurance markets in developing countries may prevent/impede market-mediated risk management and the collective entity managing the portfolio of family assets has to rely on intra-collective activity diversification to increase the mean value and reduce the variance of returns.

9 For example, while some family members are assigned to work in the traditional family business at their home location, others are dispatched abroad to engage in activities characterised by different risk-return profiles with a proportion of total income from all activities consolidated by the collective entity to support those family members engaged in less rewarding activities as well as to provide insurance against catastrophic events such as droughts, business downturns or outbreaks of hostilities.

10 For example, even when, initially, all members of the collective entity are equal and share equally its joint income, the size of membership may change when a member is dispatched by it to work at a foreign destination. In some cases (e.g., in a closely-knit family), the migrant may retain full membership rights, pool its outside earnings with the rest of the entity and share pro rata the joint income and wealth. In other cases, however, they may drop out and lose some or all of their membership rights. Also, it may be in the interests of the remaining members of the entity to alter the size of membership through member migration. For example, when the entity prospers, there may be an incentive to reduce its membership, so that the remaining members could enjoy larger per person returns. Similarly, poor returns at home location may induce the entity to keep its outsourced members closed bonded to attract remittances and other assistance.

11 These matters are addressed explicitly by the economic club literature, although most of it is not directly concerned with the spatial mobility of human capital (for a survey see Sandler and Tschirhart, 1980). The size and objectives of the club are critical to the choice of its operating rules. For example, if a particular collective entity operates as the Buchanan-style economic club (Buchanan, 1965), its ‘management’ (say senior family members) should maximise the average (per member) utility rather than the total utility of all members. Equations (5) and (6) have to be modified accordingly. They should also reflect the principal-agent structure of the collective entity as it is the principal who drives and enforces spatial relocation decisions, specifies the wealth sharing rules, and refracts the membership utility through its own utility function.

12 The sociology of migration literature has also examined the nexus between various forms of capital formation and migration through the prism of Bourdieu’s theory of capital (Bourdieu, 1985, 1986, 2006; Bourdieu and Wacquant, 1992) and Coleman’s theory of social capital (Coleman, 1990). Following Bourdieu, four forms of capital can be distinguished: economic (income, wealth, financial and physical assets), social (social networks, group membership), cultural (embodied in people as literacy, institutionalised in the form of formal educational attainments, and objectified as cultural goods), and symbolic (e.g., honour, prestige, social standing). For an extensive review of most recent literature see Vallejo and Keister (2019).

13 The remittance literature has also focused on social remittances, i.e. international transfers of norms, practices, identities, and social capital (Levitt, 1998, 2001, 2007). Arguably, the term ‘social remittances’ is a misnomer as transfers of social capital occur in both directions with both home and host destinations benefiting from (or being disadvantaged by) such flows. That said, the social remittance literature remains rather vague as to how the accumulation of social capital by economic agents impacts their subsequent mobility as migrants and the opportunity to integrate into the host community.

14 The concept of ‘social capital’ can be defined narrowly as a network of connections (often used in empirical works, e.g. Boxman et al., 1991: 52) or broadly as the generalised trust in and positive attitudes towards others (e.g., Inglehart, 1997: 188).

15 To the homo economicus, these social networks are social capital assets, which provide returns on investments in network membership. However, the initial network-related benefits may also decline or become negative over time if and when migrants get locked into their family and ethnic networks and the value of their human capital decreases as they become excessively dependent on their network access and, as a result, less socially and spatially adaptable and mobile. This is an obvious moral hazard of assistance provided through kinship and community ties.

16 The portfolio-theoretic (PT) methodology that has originally been developed by Markowitz (1952 and 1959) and refined by numerous researchers studying financial investments and the efficiency of financial markets (e.g., Hester and Tobin, 1967; Sharpe, 1970; Elton and Gruber, 1997) or the impact of structural diversification on risk-return outcomes in other areas such as industrial and regional economics (e.g., Conroy, 1975; Barth et al., 1975; Siegel et al., 1995; Chandra, 2002, 2003; Chandra and Shadel, 2007). The PT methodology allows asset diversification in investing, i.e., the selection of an asset mix that may lower the portfolio’s risk. The PT approach postulates that all risk-return combinations of different portfolios or mixes of assets lie within the parabolic frontier of which the upper segment is the efficient frontier, i.e., the model predicts the existence of a systematic nonlinear (convex) frontier relationship between returns on portfolios/mixes of assets and risks associated with holding these combinations of assets (Chandra, 2003). The PT theory has been criticised for its heavy reliance on the assumption of the Gaussian distribution of asset returns and the Markowitz parabolic frontier. Other criticisms concern its reliance on the efficient market hypothesis (Hubbard, 2009), which postulates that utility maximising market agents have rational expectations and that market information is efficiently diffused so that the population of market agents as a whole is correct in its judgments and reactions to changing asset prices and quantities, even though no one individual investor needs to be completely market savvy; and as new relevant information becomes available, it is absorbed by investors who learn and update their expectations accordingly.

17 Even a simple solution such as the sum of expected utilities presupposes the additivity of utilities derived from different components of the oeconomico’s wealth (Haug, 2008). We, therefore, leave the aggregation function unspecified as it is not critical for the following discussion.