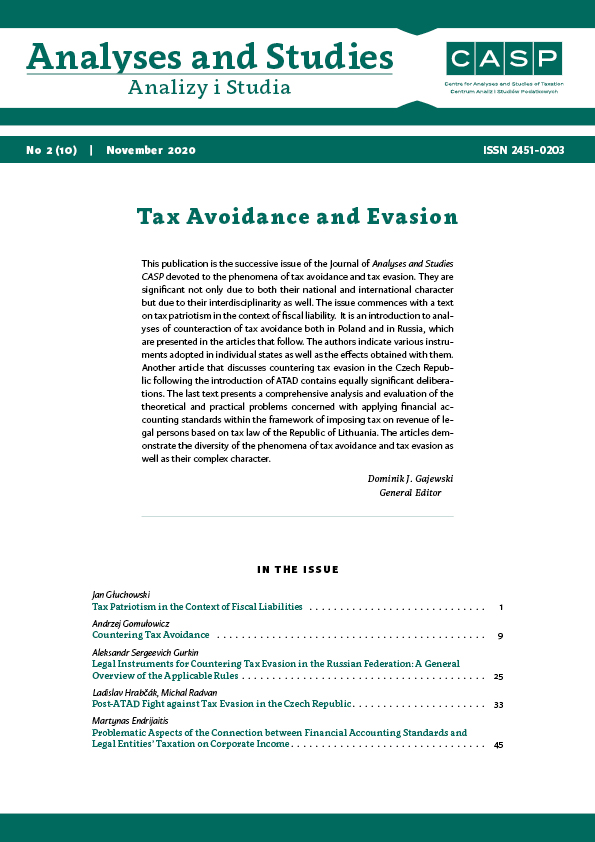

Patriotyzm podatkowy na tle zobowiązań fiskalnych

DOI:

https://doi.org/10.33119/ASCASP.2020.2.1Słowa kluczowe:

patriotyzm podatkowy, międzynarodowe prawo podatkoweAbstrakt

Autor przedstawia w ujęciu komparatystycznym zagadnienie patriotyzmu podatkowego. Wychodząc od ustaleń pojęciowych, rozważa odpowiedź na pytanie, czy płacenie podatku we własnym kraju jest patriotyczne. Na szali z jednej strony jest interes ekonomiczny, z drugiej zaś interes narodowy. Niemniej podkreślanie wagi patriotyzmu może mieć pozytywny wpływ na wzrost dyscypliny podatkowej osób fizycznych i firm.

Bibliografia

Dourado, A.P. (2017). General Raport, w: Tax Avoidance Revisited in the UE BEPS Context, European Association of Tax Law Professors Annual Congress, Munich, 2–4 June 2016, Amsterdam.

Falcone, M. (2008). On Tax Policy and Patriotism, New York Times, September.

Głuchowski, J. (2001). Zakat – islamski sposób opodatkowania, w: Księga Jubileuszowa profesora Marka Mazurkiewicza, Studia z dziedziny prawa finansowego, prawa konstytucyjnego i ochrony środowiska, R. Mastalski (red.). Wrocław: Oficyna Wydawnicza „Unimex”.

Grapperhause, F.H.M. (2010). Opowieści podatkowe drugiego millenium. Toruń: TNOiK.

Lavoie, R. (2011). Patriotism and Taxation: The Tax Compliance Implications of the Tea Party Movement, Loyola of Los Angeles Law Review, 39.

Liddell, H.G., Scott, R. (1996). Greek–English Lexicon. Oxford: Oxford University Press.

Matys, M., Góral, A. (2014). Jak ryba połknęła rybaka, Duży Format, www.wyborcza.pl, 13 marca.

Nowicki, M. (2013). Gerard Depardieu, czyli Obelix podbija Uzbekistan, Newsweek, 8 stycznia.

Pistone, P. (2020). General Report, w: Tax Procedures, EATLP Annual Congress Madrit 6–8 June 2019, Amsterdam.

Podatki miarą patriotyzmu. (2013). Gazeta Wyborcza, 10 maja.

Qari, S., Konrad, K.A., Geys, B. (2009). Patriotism, taxation and international mobility, Forschungsinstitut zur Zukunft der Arbeit Institute for the Study of Labor, Discussion Paper No 4120, April.

Seligman, E.R.A. (1892). On the Shifting and Incidence of Taxation, Publications of American Economic Association, 7 (2/3).

Siddigi, S. (1996). Zakat, w: Reaings in Islamic Fiscal Policy, S. Peerzade (ed.). Delhi: Adam Publishers.

Suchy, G. (2005). Overview of the different sources of funds, w: The Concept of Tax, B. Peters (ed.),

W.B. Barker, P.M. Herrera, K. van Raad (co-ed.), EATLP Annual Congress, Naples (Caserta), May 27–29, Amsterdam.

Pobrania

Opublikowane

Jak cytować

Numer

Dział

Licencja

Autor (Autorzy) artykułu oświadcza, że przesłane opracowanie nie narusza praw autorskich osób trzecich. Wyraża zgodę na poddanie artykułu procedurze recenzji oraz dokonanie zmian redakcyjnych. Przenosi nieodpłatnie na Oficynę Wydawniczą SGH autorskie prawa majątkowe do utworu na polach eksploatacji wymienionych w art. 50 Ustawy z dnia 4 lutego 1994 r. o prawie autorskim i prawach pokrewnych – pod warunkiem, że praca została zaakceptowana do publikacji i opublikowana.

Oficyna Wydawnicza SGH posiada autorskie prawa majątkowe do wszystkich treści czasopisma. Zamieszczenie tekstu artykuły w repozytorium, na stronie domowej autora lub na innej stronie jest dozwolone o ile nie wiąże się z pozyskiwaniem korzyści majątkowych, a tekst wyposażony będzie w informacje źródłowe (w tym również tytuł, rok, numer i adres internetowy czasopisma).

Osoby zainteresowane komercyjnym wykorzystaniem zawartości czasopisma proszone są o kontakt z Redakcją.

Autor zgadza się na dalsze udostępnianie pracy wg wymagań licencji CC-BY-NC