Wierzytelności nieściągalne i terminy przedawnienia w podatku VAT – sprawa ENERGOTT

DOI:

https://doi.org/10.33119/ASCASP.2021.1.1Słowa kluczowe:

VAT, zasada neutralności, zasada skuteczności, zasada równoważności, przepisy o przedawnieniu, ostatecznie nieściągalne wierzytelnościAbstrakt

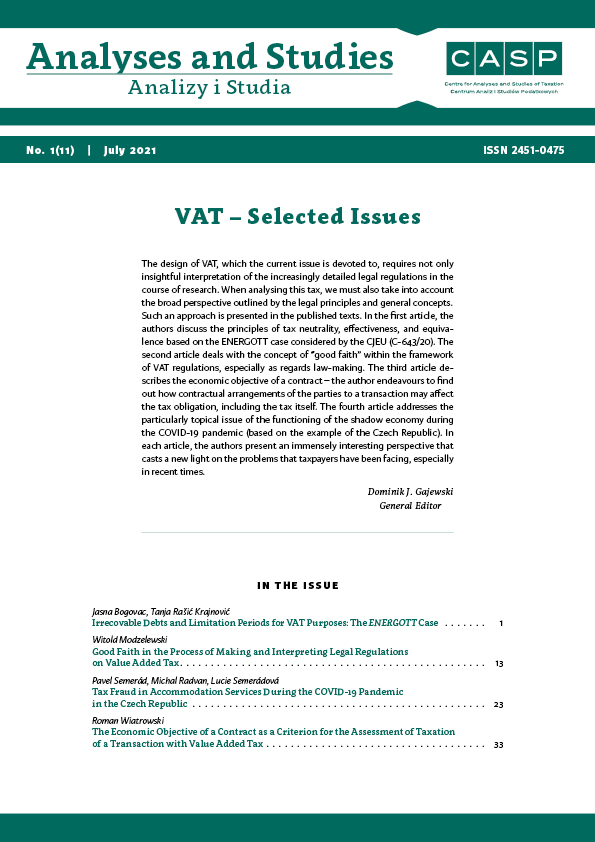

Autorzy przedstawiają bieżącą sprawę ENERGOTT rozstrzyganą przed Trybunałem Sprawiedliwości Unii Europejskiej (C-643/20), w której we wniosku o wydanie orzeczenia w trybie prejudycjalnym są kwestionowane trzy zasady podatku VAT: równoważności, skuteczności i neutralności. Przedmiotem wniosku jest zwrot podatku VAT odnoszący się do wierzytelności, które stały się ostatecznie nieściągalne. Trybunał został poproszony o określenie momentu, który państwa członkowskie mogą uznać za początek biegu terminu przedawnienia zwrotu podatku VAT przysługującego za takie wierzytelności oraz o ustalenie, czy warunki ustanowione przez państwo członkowskie w odniesieniu do zwrotu podatku VAT podlegają

wyłączeniu w myśl europejskiego orzecznictwa i europejskich zasad. Sprawa ta jest ważna z punktu widzenia podatników w Unii Europejskiej, ponieważ wyrok, który zapadnie, może w pewnych okolicznościach dać im prawo kwestionować przepisy krajowe w zakresie terminu przedawnienia.

Bibliografia

Almos Agrárkülkereskedelmi Kft v Nemzeti Adó- és Vámhivatal Közép-magyarországi Regionális Adó Főigazgatósága [2014] Case no. C-337/13. ECLI:EU:C:2014:328. Retrieved from: https://curia.europa.eu/juris/document/document.jsf?text=docid=152344&pageIndex=0&doclang=EN&mode=lst&dir=&occ=first&part=1&cid=3238872 (accessed: 25.3.2021).

A-PACK CZ s.r.o. v Odvolací finanční ředitelství [2017] Case no. C-127/18. ECLI:EU:C:2019:377. Retrieved from: https://curia.europa.eu/juris/document/document.jsf;jsessionid=EF2C55CD7F4211457341B1F34796E189?text=&docid=213864&pageIndex=0&doclang=en&mode=lst&dir=&occ=first&part=1&cid=10821175 (accessed: 17.3.2021).

Arbutina, H., & Bogovac, J. (2014). Tax Law. In: T. Josipović (Ed.), Introduction to the Law of Croatia. Alphen aan den Rijn: Kluwer Law International, pp. 481–503.

Biosafe – Indústria de Reciclagens SA v Flexipiso – Pavimentos SA [2018] Case no. C-8/17. ECLI:EU:C:2018:249. Retrieved from: https://curia.europa.eu/juris/document/document.jsf?text=&docid=200962&pageIndex=0&doclang=en&mode=lst&dir=&occ=first&part=1&cid=4081366 (accessed: 2.4.2021).

Bogovac, J. (2020). Building a Better Tax System for Sustainable Development: The Case of the Central and Eastern European Countries. In: C. Brokelind, S. van Thiel (Eds.), Tax Sustainability in an EU and International Context. Amsterdam, The Netherlands: IBFD, pp. 137–158.

Bogovac, J., & Rašić Krajnović, T. (2017). VAT on touristic services in Croatia – history and membership in the EU. In: N. Radionov, I. Koprić (Eds.), Spomenica prof. dr. sc. Juri Šimoviću. Zagreb: Faculty of Law, University of Zagreb, pp. 79–103.

ENERGOTT Fejlesztő és Vagyonkezelő Kft. v Nemzeti Adó- és Vámhivatal Fellebbviteli Igazgatósága [2020] Case no. C-643/20. Request for a preliminary ruling from the Veszprémi Törvényszék (Hungary). Retrieved from: https://curia.europa.eu/juri/document/document.jsf;jsessionid=166DB96A95F346595049F04DE9B2EB27?text=&docid=239105&pageIndex=0&doclang=EN&mode=lst&dir=&occ=first&part=1&cid=2093518 (accessed: 9.3.2021).

Enzo Di Maura v Agenzia delle Entrate – Direzione Provinciale di Siracusa [2017] Case no. C‑246/16. ECLI:EU:C:2017:887. Retrieved from: https://curia.europa.eu/juris/document/document.jsf?text=&docid=197048&pageIndex=0&doclang=enmode=lst&dir=&occ=first&part=1&cid=10821672 (accessed: 27.3.2021).

E. sp. z o.o. sp. k. v Minister Finansów [2020] Case no. C-335/19. ECLI:EU:C:2020:829. Retrieved from: https://curia.europa.eu/juris/document/document.jsf?text=&docid=232430&pageIndex=0&doclang=en&mode=lst&dir=&occ=first&part=1&cid=10823625 (accessed: 22.3.2021).

FGSZ Földgázszállító Zrt. v Nemzeti Adó- és Vámhivatal Fellebbviteli Igazgatósága [2021] Case no. C‑507/20. ECLI:EU:C:2021:157. Retrieved from: https://curia.europa.eu/juris/document/document.jsf?text=&docid=238703&pageIndex=0doclang=ENmode=lst&dir=&occ=first&part=1&cid=2107177 (accessed: 20.3.2021).

Littlewoods Retail Ltd and Others v Her Majesty’s Commissioners of Revenue and Customs [2012] Case no. C-591/10. ECLI:EU:C:2012:478. Opinion of AG Trstenjak. Retrieved from: https://eur-lex.europa.eu/legalcontent/EN/TXT/HTML/?uri=CELEX:62010CC0591&from=BG (accessed: 17.4.2021).

GST – Sarviz AG Germania [2015] Case no. C-111/14. ECLI:EU:C:2015:267. Retrieved from: https://curia.europa.eu/juris/document/document.jsf?text=&docid=163873&pageIndex=0&doclang=en&mode=lst&dir=&occ=first&part=1&cid=9534220 (accessed: 19.3.2021).

Lombard Ingatlan Lízing Zrt v Nemzeti Adó- és Vámhivatal Fellebbviteli Igazgatóság [2017] Case no. C-404/16. ECLI:EU:C:2017:759. Retrieved from: https://curia.europa.eu/juris/document/document.jsf?text=&docid=195433&pageIndex=0&doclang=EN&mode=req&dir=&occ=first&part=1&cid=3244205 (accessed: 21.3.2021).

MyTravel plc v Commissioners of Customs & Excise [2005] Case no. C-291/03. Retrieved from: https://curia.europa.eu/juris/document/document.jsf?text=&docid=60240&pageIndex=0&doclang=en&mode=lst&dir=&occ=first&part=1&cid=9523274 (accessed: 17.3.2021).

Porr Építési Kft. v Nemzeti Adó- és Vámhivatal Fellebbviteli Igazgatósága [2020] Case no. C-292/19. ECLI:EU:C:2019:901. Retrieved from: https://curia. europa.eu/juris/document/document.jsf?docid=21 9713&mode=req&pageIndex=1&dir=&occ=first&part=1&text=&doclang=FR&cid=10822796 (accessed: 12.4.2021).

Radu Florin Salomie, Nicolae Vasile Oltean v Direcția Generală a Finanțelor Publice Cluj [2015] Case no. C183/14. ECLI:EU:C:2015:454. Retrieved from: https://curia.europa.eu/juris/document/document.jsf?text=&docid=165649&pageIndex=0 doclang=en&mode=lst&dir=&occ=first&part=1&cid=10823942 (accessed: 26.3.2021).

T‑2, družba za ustvarjanje, razvoj in trženje elektronskih komunikacij in opreme, d.o.o., in insolvency, v Republika Slovenija [2018] Case no.C‑396/16.ECLI:EU:C:2018:109. Retrieved from: https://curia.europa.eu/juris/document/document.jsf?docid=199569&mode=req&pageIndex=1&dir=&occ=first&part=1&text=&doclang=EN&cid=10822272 (accessed: 24.3.2021).

Pobrania

Opublikowane

Jak cytować

Numer

Dział

Licencja

Autor (Autorzy) artykułu oświadcza, że przesłane opracowanie nie narusza praw autorskich osób trzecich. Wyraża zgodę na poddanie artykułu procedurze recenzji oraz dokonanie zmian redakcyjnych. Przenosi nieodpłatnie na Oficynę Wydawniczą SGH autorskie prawa majątkowe do utworu na polach eksploatacji wymienionych w art. 50 Ustawy z dnia 4 lutego 1994 r. o prawie autorskim i prawach pokrewnych – pod warunkiem, że praca została zaakceptowana do publikacji i opublikowana.

Oficyna Wydawnicza SGH posiada autorskie prawa majątkowe do wszystkich treści czasopisma. Zamieszczenie tekstu artykuły w repozytorium, na stronie domowej autora lub na innej stronie jest dozwolone o ile nie wiąże się z pozyskiwaniem korzyści majątkowych, a tekst wyposażony będzie w informacje źródłowe (w tym również tytuł, rok, numer i adres internetowy czasopisma).

Osoby zainteresowane komercyjnym wykorzystaniem zawartości czasopisma proszone są o kontakt z Redakcją.

Autor zgadza się na dalsze udostępnianie pracy wg wymagań licencji CC-BY-NC