Gospodarczy cel zawarcia umowy jako kryterium oceny opodatkowania transakcji podatkiem od towarów i usług

DOI:

https://doi.org/10.33119/ASCASP.2021.1.4Słowa kluczowe:

VAT, umowy, cel gospodarczyAbstrakt

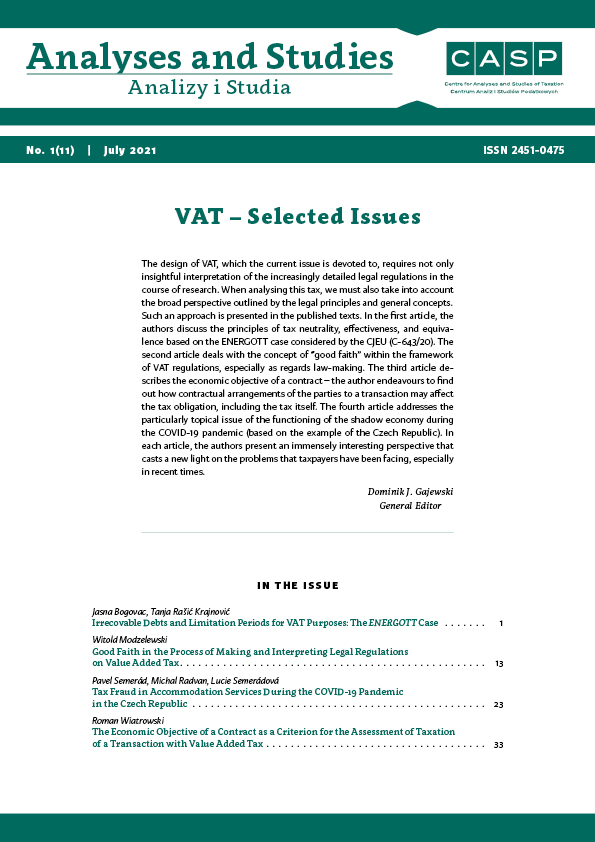

Celem artykułu jest opisanie, w jaki sposób porozumienia umowne stron transakcji mogą wpływać na kształt obowiązku podatkowego w podatku od towarów i usług. W szczególności chodzi o to, aby przedstawić, jakie znaczenie dla skutków podatkowych w VAT ma gospodarczy cel umowy. Warto było zweryfikować, jakie elementy stosunku prawnopodatkowego mogą zostać ukształtowane przez porozumienia umowne. W artykule wskazano również, kiedy – dla ukształtowania obowiązków w VAT – warunki umowne nie mogą być w ogóle brane pod uwagę. Jako metodę opisową wybrano orzecznictwo Trybunału Sprawiedliwości Unii Europejskiej, w którym wywodząc skutki podatkowe różnych zdarzeń gospodarczych, oceniono wpływ woli stron umowy na te skutki.

Bibliografia

Ciecierski, M. (2019). Czynność cywilnoprawna a kształtowanie obowiązku podatkowego w podatku od towarów i usług na przykładzie robót budowlanych i budowlano - montażowych. In: A. Franczak, A. Kaźmierczyk (Eds.), Prawo podatkowe w systemie prawa. Międzygałęziowe związki norm i instytucji prawnych (pp. 259–270). Warszawa: Wolters Kluwer Polska

Kasprzyk, K. & Verdun, M. (2019). Kiedy zbudowano piramidę Cheopsa – rozważania dotyczące momentu wykonania usługi budowlanej w świetle wyroku w sprawie Budimex. Przegląd Podatkowy, 7, pp. 14–22.

Wesołowska, A. (2019). Moment powstania obowiązku podatkowego VAT w przypadku usług budowlanych lub budowlano-montażowych. Glosa do wyroku TS z dnia 2 maja 2019 r. C-224/18. LEX/el.

Pobrania

Opublikowane

Jak cytować

Numer

Dział

Licencja

Autor (Autorzy) artykułu oświadcza, że przesłane opracowanie nie narusza praw autorskich osób trzecich. Wyraża zgodę na poddanie artykułu procedurze recenzji oraz dokonanie zmian redakcyjnych. Przenosi nieodpłatnie na Oficynę Wydawniczą SGH autorskie prawa majątkowe do utworu na polach eksploatacji wymienionych w art. 50 Ustawy z dnia 4 lutego 1994 r. o prawie autorskim i prawach pokrewnych – pod warunkiem, że praca została zaakceptowana do publikacji i opublikowana.

Oficyna Wydawnicza SGH posiada autorskie prawa majątkowe do wszystkich treści czasopisma. Zamieszczenie tekstu artykuły w repozytorium, na stronie domowej autora lub na innej stronie jest dozwolone o ile nie wiąże się z pozyskiwaniem korzyści majątkowych, a tekst wyposażony będzie w informacje źródłowe (w tym również tytuł, rok, numer i adres internetowy czasopisma).

Osoby zainteresowane komercyjnym wykorzystaniem zawartości czasopisma proszone są o kontakt z Redakcją.

Autor zgadza się na dalsze udostępnianie pracy wg wymagań licencji CC-BY-NC