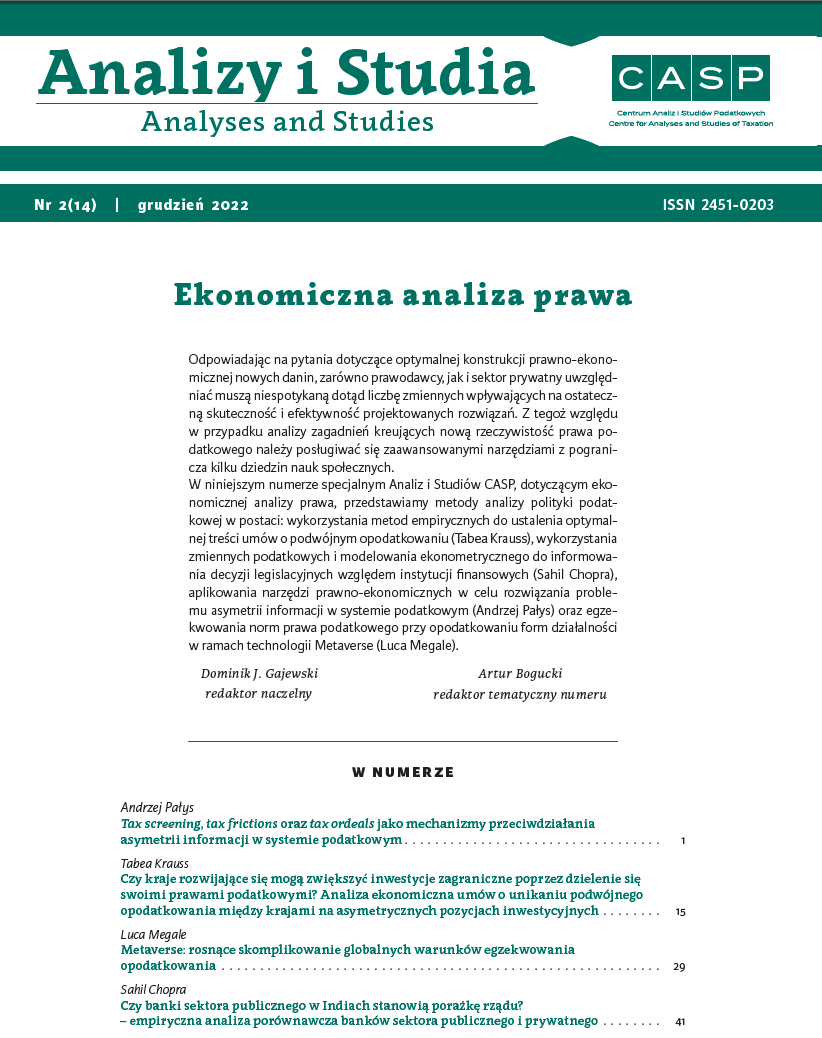

Tax screening, tax frictions oraz tax ordeals jako mechanizmy przeciwdziałania asymetrii informacji w systemie podatkowym

DOI:

https://doi.org/10.33119/ASCASP.2022.2.1Słowa kluczowe:

unikanie opodatkowania, uchylanie się od opodatkowania, asymetria informacji, kwalifikacja podatkowa, tarcia podatkoweAbstrakt

Artykuł prezentuje system podatkowy jako zagadnienie z obszaru asymetrii informacji. Omawia również trzy mechanizmy pozwalające na obniżenie negatywnego wpływu tej asymetrii na kształtowanie systemu podatkowego oraz poziom zgodności podatkowej w gospodarce. Kwalifikacja podatkowa (tax screening) to zbiór rozwiązań pozwalających na określenie charakterystyk grup podatników na podstawie dokonywanych przez nich wyborów podatkowych. Zwiększa to wiedzę ustawodawcy i organów podatkowych o podatnikach i pozwala na podejmowanie efektywnych decyzji konstrukcyjnych w zakresie systemu podatkowego oraz bardziej precyzyjne działania kontrolne. Tarcia podatkowe (tax frictions) w sposób automatyczny zniechęcają podatników do dokonywania określonych, niezgodnych z intencją ustawodawcy, wyborów podatkowych, zmniejszając intensywność i koszty działań korygujących. Wyzwania podatkowe (tax ordeals) nakładają dodatkowe koszty na niektóre procedury związane z benefitami podatkowymi, zwiększając prawdopodobieństwo, że korzystają z nich jedynie podmioty uprawnione. Artykuł analizuje powyższe mechanizmy niwelowania asymetrii informacji w systemie podatkowym w kontekście teoretycznym oraz praktycznym, a także przedstawia rekomendacje dla ich efektywnego wdrażania.

Bibliografia

Avi-Yonah, R. (2000, May). Globalization, Tax Competition, and the Fiscal Crisis of the Welfare State. 113 Harvard Law Review.

Blundell, R., & Preston, I. (2019). Principles of Tax Design, Public Policy and Beyond: The Ideas of James Mirrlees, 1936–2018. Fiscal Studies, 40(1), 5–18.

Brown, S., & Sessions, J. (2004). Signalling and Screening. In: G. Johnes, J. Johnes (Eds.), International Handbook on the Economics of Education. Edward Elgar Publishing.

Braithwaite, V. (2003). Dancing with Tax Authorities: Motivational Postures and Noncompliant Actions. Cauble, E. (2013). Tax Elections: How to Live with Them If We Can’t Live without Them. Santa Clara Tax Review, 53.

Field, H. (2011). Tax Elections & Private Bargaining. 31 Virginia Tax Review, 1.

Jagodziński, W. (2019). Asymetria informacji jako źródło dysfunkcjonalnych instytucji formalnych [Information Asymmetry as a Source of Formal Dysfunctional Institutions]. Przedsiębiorstwo we współczesnej gospodarce– teoria i praktyka, 1(28), 43–55 [Enterprise in the Modern Economy – Theory and Practice].

Karabarbounis, M. (2015). A Road Map for Efficiently Taxing

Heterogeneous Agents. Working Paper No. 13–13r.

Kenneth, L. & Judd, D. (2017). Optimal Income Taxation with Multidimensional Taxpayer Types. Stanford Research.

Lofgren, K., Persson, T., & Weibull, J. (2002). Markets with the Asymmetric Information. Scandinavian Journal of Economics, 104.

Ma, D., Judd, K.L., Orban, D., & Saunders, M.A. (2017). Stabilized optimization via an NCL algorithm. In Numerical Analysis and Optimization (pp. 173-191). Springer, Cham.

Mirrlees, J. (1990, Jan). Taxing Uncertain Incomes. Oxford Economic Papers, 42(1). Mun, I., (2016). Reinterpreting Corporate Inversions: Non-Tax Competitions and Frictions. Yale Law Journal, 126.

Osofsky, L. (2013). Who’s naughty and who’s nice-frictions, screening, and tax law design. Buff. L. Rev., 61, 1057.

Palys, A. (2022). Nowoczesna relacja organów podatkowych z podatnikami. Koncepcje teoretyczne oraz analiza praktyczna na przykładzie systemu nadzoru horyzontalnego. C.H. Beck.

Pope, J. (1992). The Compliance Costs of Taxation in Australia: An Economic and Policy Perspective. Division of Business and Administration, School of Economics and Finance, Curtin University of Technology.

Satterthwaite, E. (2016). Tax Elections as Screens, Queen’s Law Journal, 42.

Schizer, D.M. (2001). Frictions as a constraint on tax planning. Colum. L. Rev., 101, 1312.

Shaviro, D.N. (2001). Evaluating the Social Costs of Corporate Tax Shelters. Tax L. Rev., 55, 445.

Stern N. (1982). Optimum Taxation with Errors in Administration. Public Economies, 181.

Stiglitz, J. (1985). The General Theory of Tax Avoidance. National Tax Journal, XXXVIII(3).

Strnad, J. (2004). The Progressivity Puzzle: The Key Role of Personal Attributes. Stanford Law School.

Weisbach, D. (2009). Toward a New Approach to Disability Law. University of Chicago Legal Forum, 47.

Zelenak, L. (2013). Learning to Love form 1040: Two Cheers for the Return-Based Mass Income Tax. Chicago: University of Chicago Press.

Pobrania

Opublikowane

Jak cytować

Numer

Dział

Licencja

Autor (Autorzy) artykułu oświadcza, że przesłane opracowanie nie narusza praw autorskich osób trzecich. Wyraża zgodę na poddanie artykułu procedurze recenzji oraz dokonanie zmian redakcyjnych. Przenosi nieodpłatnie na Oficynę Wydawniczą SGH autorskie prawa majątkowe do utworu na polach eksploatacji wymienionych w art. 50 Ustawy z dnia 4 lutego 1994 r. o prawie autorskim i prawach pokrewnych – pod warunkiem, że praca została zaakceptowana do publikacji i opublikowana.

Oficyna Wydawnicza SGH posiada autorskie prawa majątkowe do wszystkich treści czasopisma. Zamieszczenie tekstu artykuły w repozytorium, na stronie domowej autora lub na innej stronie jest dozwolone o ile nie wiąże się z pozyskiwaniem korzyści majątkowych, a tekst wyposażony będzie w informacje źródłowe (w tym również tytuł, rok, numer i adres internetowy czasopisma).

Osoby zainteresowane komercyjnym wykorzystaniem zawartości czasopisma proszone są o kontakt z Redakcją.

Autor zgadza się na dalsze udostępnianie pracy wg wymagań licencji CC-BY-NC