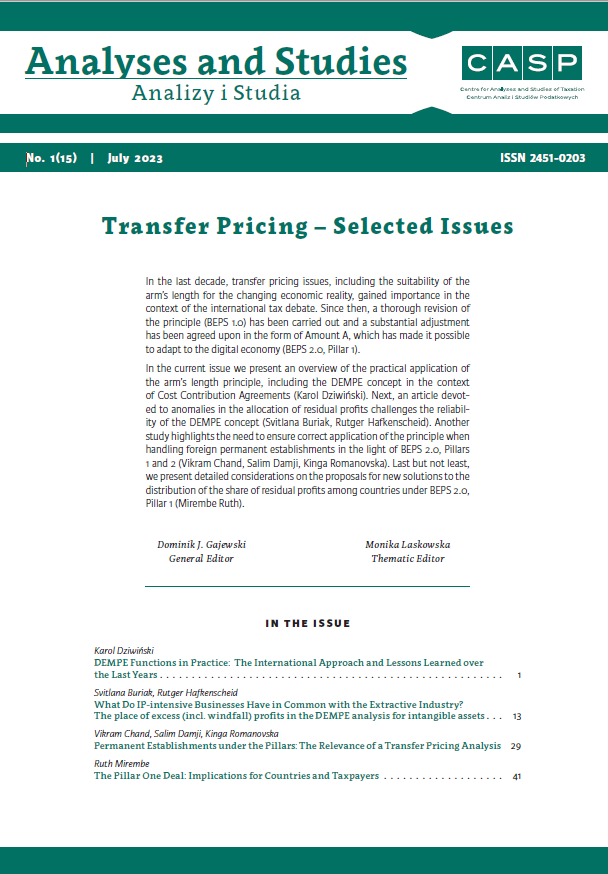

Funkcje DEMPE w praktyce – nauka wyciągnięta z ostatnich lat oraz podejście międzynarodowe

DOI:

https://doi.org/10.33119/ASCASP.2023.1.1Słowa kluczowe:

DEMPE, wartości niematerialne i prawne, ceny transferowe, międzynarodowe prawo podatkowe, licencjonowanie, CCA, porozumienia w sprawie podziału kosztówAbstrakt

Artykuł omawia stosowanie koncepcji DEMPE w praktyce od czasu jej oficjalnego wprowadzenia w ramach Wytycznych OECD w sprawie cen transferowych z 2017 r. Rozważania rozpoczynają się od uplasowania koncepcji w realiach cen transferowych, a następnie przechodzą do najczęstszych problemów napotykanych w praktyce jej stosowania, co obejmuje również analizę zastosowania DEMPE odnośnie do porozumień w sprawie podziału kosztów. Na koniec w artykule przedstawiono rzeczywiste przykłady zastosowania koncepcji DEMPE w krajach takich jak Austria, Belgia, Chiny, Niemcy i Indie.

Bibliografia

Dhadphale, A. (2019). Concept of DEMPE and its Debut in Indian TP Litigation. Taxsutra. Retrieved from: https://www.taxsutra.com/tp/experts-corner/conceptdempe-and-its-debut-indian-tp-litigation

Dziwiński, K. (2022). The DEMPE Concept and Intangibles. Definition, Practical Approach and Analysis in the Context of Licence Model, Alphen aan den Rijn. The Netherlands: Kluwer Law International B.V., Chapter 3, 82–85, 161–165, 181–191.

Kost, O. & Weidlich, F. (2020). Möglichkeiten zur Operationalisierung einer DEMPE-Analyse. TPI Transfer Pricing International, 5, 235–338.

Lagarden, M. & Peng, C. (X.) (2019). DEMPE Functions and the RACI Concept – More Clarity or Confusio Ahead? International Transfer Pricing Journal, 26(1).

Markley, B. & Devroye, R. (2021). “Back to the future?” – Belgian Court rules that DEMPE concept cannot be applied retroactively. Wolter Kluwer International Tax Blog. Retrieved from: https://kluwertaxblog.com/2021/09/13/back-to-the-future-belgian-court-rules-that-dempeconcept-cannot-be-applied-retroactively/

Schoueri, L.E. (2015). Arm’s Length: Beyond the Guidelines of the OECD. Bulletin for International Taxation, 69(12), 714–716.

Screpante, M.S. (2019). Formulaic (or Formulary?!) Apportionment Wearing Value Creation Clothes: Is the Wolf Dressed in Sheep’s Clothing? Kluwer International Tax Blog. Retrieved from: https://kluwertaxblog.com/2019/09/10/formulaic-or-formulary-apportionment-wearing-value-creation-clothes-is-the-wolfdressed-in-sheeps-clothing/.

Screpante, M.S. (2019). Rethinking the Arm’s Length Principle and Its Impact on the IP Licence Model after OECD/G20 BEPS Actions 8-10: Nothing Changed but the Change? World Tax Journal, 11(3).

Stocker, R. & Schmid, P. (2018). Markenrechte: Entschädigung des rechtlichen Eigentümers vs Ausübung von DEMPE-Funktionen. TPI Transfer Pricing International, 4, 218.

Subramanian, P. (2017). Ten Questions on the OECD’s DEMPE Concept and Its Role in Valuing Intangibles. Bloomberg Tax Management Transfer Pricing Report, 26.

Wilkie, S. (2019). The Way We Were? The Way We Must Be? The ‘Arm’s Length Principle’ Sees Itself (for What It Is) in the ‘Digital Mirror’. Intertax, 47(12), 1098.

Yuan S. & Zhao A. (2017). Bulletin 6: China Completes the Revamping of Its Transfer Pricing Regime, International Transfer Pricing Journal, 24(4), 294. Legal Acts and Guidance and Court Decisions

Bundesministerium Finanzen (AT), VPR 2021. Verrechnungspreisrichtlinien 2021. GZ 2021-0.586.616. Retrieved from: https://findok.bmf.gv.at/findok?execution=e100000s1&dokumentId=ace379c96082-4d25-b31a-456515264bee

Bundesministerium der Finanzen (DE) of 8 June 2021. Gesetz zur Modernisierung der Entlastung von Abzugsteuern und der Bescheinigung der Kapitalertragsteuer (Abzugsteuerentlastungsmodernisierungsgesetz – AbzStEntModG). Retrieved from: https://www.bundesfinanzministerium.de/Content/DE/Gesetzestexte/ Gesetze_Gesetzesvorhaben/Abteilungen/Abteilung_IV/19_Legislaturperiode/Gesetze_Verordnungen/2021-06-08-AbzStEntModG/0-Gesetz.html

Bundesministerium der Finanzen (DE) of 14 July 2021. Verwaltungsgrundsätze Verrechnungspreise. Retrieved from: https://www.bundesfinanzministerium.de/Content/DE/Downloads/BMF_Schreiben/Internationales_Steuerrecht/Allgemeine_Informationen/2021-07-14-verwaltungsgrundsaetze-verrechnungspreise.pdf?__blob=publicationFile&v=6

Circulaire 2020/C/35 concernant les directives en matière de prix de transfert à l’intention des entreprises multinationales et des administrations fiscales. SPS Finances (25 February 2020). Retrieved from: https://eservices.minfin.fgov.be/myminfin-web/pages/fisconet/document/25aa2105-24d3-4b13-89dd-2f9ba7db7e63

Income Tax Appellate Tribunal of 23 August 2019, M/s L’Oréal India Pvt. Ltd. Vs. Deputy Commissioner of Income Tax, Circle 7(1)(2), TS-829-ITAT-2019(Mum)-TP, ITA No. 7194/Mum/2017.

OECD (2015). Executive summary, Aligning Transfer Pricing Outcomes with Value Creation. Actions 8-10: 2015 Final Reports, OECD/G20 Base Erosion and Profit Shifting Project. Paris: OECD.

SAT Public Notice (2017) No. 6 of 22 November 2017. Public Notice of the State Administration of Taxation on Issuing the “Administrative Measures of Special Tax Investigation and Adjustment and Mutual Agreement Procedure”. Retrieved from: http://www.chinatax.gov.cn/download/pdf/20171122.pdf

SPS Finances, 25.02.2020. Circulaire 2020/C/35 concernant les directives en matière de prix de transfert à l’intention des entreprises multinationales et des administrations fiscales. SPS Finances. Retrieved from: https://eservices.minfin.fgov.be/myminfin-web/pages/fisconet/document/25aa2105-24d3-4b13-89dd-2f9ba7db7e63

Verwaltungsgerichtshof (AT)/Austrian Supreme Administrative Tribunal of 27 February 2020, Ra 2019/15/0162. Retrieved from: https://www.ris.bka.gv.at/Dokument.wxe?ResultFunctionToken=98a9e257-9c50-4ec3-8a96-11f3003a5523&Position=1&Abfrage=Vwgh&Entscheidungsart=Erkenntnis&Sammlungsnummer=&Index=&AenderungenSeit=Undefined&SucheNachRechtssatz=False&SucheNachText=True&GZ=&VonDatum=&BisDatum=&Norm=&ImRisSeitVonDatum=&ImRisSeitBisDatum=&ImRisSeit=EinemMonat&ResultPageSize=50&Suchworte=&Dokumentnummer=JWT_2019150162_20201127L00

Pobrania

Opublikowane

Wersje

- 2024-03-22 - (2)

- 2023-08-31 - (1)

Jak cytować

Numer

Dział

Licencja

Autor (Autorzy) artykułu oświadcza, że przesłane opracowanie nie narusza praw autorskich osób trzecich. Wyraża zgodę na poddanie artykułu procedurze recenzji oraz dokonanie zmian redakcyjnych. Przenosi nieodpłatnie na Oficynę Wydawniczą SGH autorskie prawa majątkowe do utworu na polach eksploatacji wymienionych w art. 50 Ustawy z dnia 4 lutego 1994 r. o prawie autorskim i prawach pokrewnych – pod warunkiem, że praca została zaakceptowana do publikacji i opublikowana.

Oficyna Wydawnicza SGH posiada autorskie prawa majątkowe do wszystkich treści czasopisma. Zamieszczenie tekstu artykuły w repozytorium, na stronie domowej autora lub na innej stronie jest dozwolone o ile nie wiąże się z pozyskiwaniem korzyści majątkowych, a tekst wyposażony będzie w informacje źródłowe (w tym również tytuł, rok, numer i adres internetowy czasopisma).

Osoby zainteresowane komercyjnym wykorzystaniem zawartości czasopisma proszone są o kontakt z Redakcją.

Autor zgadza się na dalsze udostępnianie pracy wg wymagań licencji CC-BY-NC