Co łączy sektory intensywnie korzystające z praw własności intelektualnej z przemysłem wydobywczym?

Miejsce nadwyżek zysku (w tym nieoczekiwanych) w analizie DEMPE dotyczącej wartości niematerialnych

DOI:

https://doi.org/10.33119/ASCASP.2023.1.2Słowa kluczowe:

windfall profit, economic crisis, transfer pricing, economic rent, residual profit, intellectual property, DEMPE, value creation, value capture, International taxation, income allocationAbstrakt

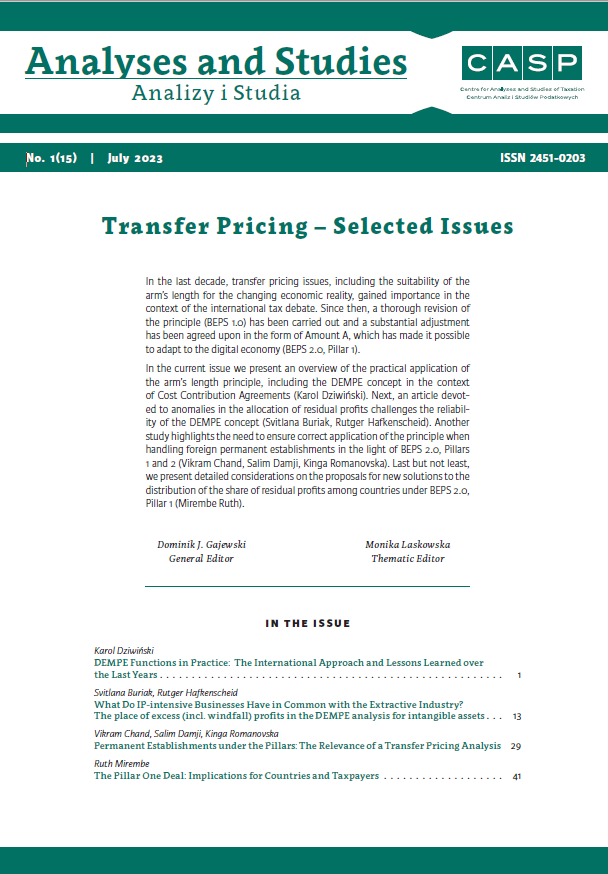

W tym artykule poruszamy jedną z najchętniej w ostatnim czasie omawianych, a jednocześnie budzącą największe kontrowersje, kwestię luki w zakresie cen transferowych: jak zakłócenia na rynku, dominująca siła rynkowa oraz warunki ekonomiczne, które nie wpasowują się w normalny cykl gospodarczy, powinny wpływać na analizę cen transferowych w transakcjach kontrolowanych? W czasie ostatnich kryzysów gospodarczych wywołanych pandemią COVID-19 oraz kryzysu bezpieczeństwa energetycznego, będącego konsekwencją rosyjskiej inwazji na Ukrainę, stało się jasne, że zyski przedsiębiorstw mogą nie zawsze być bezpośrednim wynikiem decyzji inwestorów lub – w kontekście cen transferowych – sprawowanych funkcji, wykorzystanych aktywów lub podjętego ryzyka, lecz skutkiem okoliczności zewnętrznych. Tego typu czynniki zewnętrzne mogą obejmować szybko postępujące zakłócenia w równowadze podaży i popytu w przypadku niektórych towarów lub usług, takich jak na przykład oprogramowanie czy zasoby energetyczne. Jednakże niektóre siły zewnętrzne nie są związane z etapem cyklu gospodarczego – między innymi siła rynkowa lub zaburzona konkurencja, tj. oligopol, monopol lub monopson na rynku. W tym artykule podnosimy, że zdolność niektórych sektorów gospodarki do uzyskiwania nadprogramowych zysków nie jest jedynie kwestią szczęścia ani nieprzewidywalnych zdarzeń. W rzeczywistości posiadanie pewnych ograniczonych zasobów lub sztucznie ograniczanych aktywów przesądza o zdolności do generowania nadwyżek (rezydualnych) zysków. Wskazujemy na podobieństwo pomiędzy zasobami naturalnymi generującymi renty ekonomiczne a aktywami z gatunku własności intelektualnej, których niedobór urzeczywistnia się dzięki rozwiniętemu systemowi ochrony praw własności intelektualnej (w szczególności patentowej), aby wykazać ich wspólną cechę jako aktywów generujących renty. Ponownie kwestionujemy słuszność koncepcji tworzenia wartości, argumentując, że nie uwzględnia ona poziomu konkurencji, siły i kontroli rynkowej oraz niedoborów na rynku, które stanowią główne czynniki pozwalające przedsiębiorstwom generować wysokie zyski. Wreszcie poddajemy w wątpliwość zasadność stosowania mainstreamowej koncepcji DEMPE dla celów alokacji zysków z wartości niematerialnych, ponieważ przypisuje ona zbyt dużą wagę stadium rozwoju wartości niematerialnych i prawnych. W myśl założenia, że ochrona praw własności intelektualnej może wywołać na rynku sztuczny niedobór produktów chronionych tymi prawami, co zaburza konkurencję i umożliwia właścicielom tych praw wypracowywanie większych zysków, jurysdykcja rynkowa powinna mieć prawo do udziału w zysku rezydualnym, ponieważ za jej sprawą reżim ochrony własności intelektualnej może funkcjonować.

Bibliografia

Acemoglu, C., & Robison, J.A. (2012). Why Nations Fail. The Origins of Power, Prosperity, and Poverty. Crown Business.

Baunsgaard, M.T., & Vernon, N. (2022). Taxing Windfall Profits in the Energy Sector. International Monetary Fund.

Beer, S., De Mooij, R.A., Hebous, S., Keen, M.M., & Liu, M.L. (2020). Exploring residual profit allocation. International Monetary Fund.

Boadway, R., & Keen, M. (2010). Theoretical perspectives on resource tax design. In: The taxation of petroleum and minerals (pp. 29–90). Routledge.

Buriak, S., 2023 (forthcoming). International Taxation of Business Income in Globalised and Digitalised Economy: Non-equity modes of internationalisation of scalewithout-mass businesses and economic rents as residual profits. IBFD Doctoral Series.

Christophers, B. (2021). Class, assets, and work in rentier capitalism. Historical Materialism, 29(2), 3.

Cui, W., & Hashimzade, N. (2019). The digital services tax as a tax on location-specific rent. Available at SSRN 3488812.

Dernis, H., Gkotsis, P., Grassano, N., Nakazato, S., Squicciarini, M., van Beuzekom, B., & Vezzani, A. (2019). World corporate top R&D investors: Shaping the future of technologies and of AI (No. JRC117068). Joint Research Centre (Seville).

Devereux, M. P. et al. (2019). Residual profit allocation by income, WP 19/01. CBT Oxford.

Durand, C., & Milberg, W. (2020). Intellectual monopoly in global value chains. Review of International Political Economy, 27(2), 404.

Hafkenscheid, R.P.F.M. (2017, Jan/Feb). The BEPS Report on Risk Allocation: Not so Functional. International Transfer Pricing Journal, 19–24.

Hebous, S., Prihardini, D., & Vernon, N. (2022). Excess Profit Taxes: Historical Perspective and Contemporary Relevance. International Monetary Fund.

Hieminga, G., & van Sante, M. (2022). The sectors most affected by soaring energy prices. Retrieved from: https://think.ing.com/articles/the-sectors-most-affected-bysoaring-energy-prices (accessed: 06/01/2023).

Hollinger, P., White, S., Speed, M., & Dunai, M. (2022). Will the energy crisis crush European industry? Financial Times. Retrieved from: https://www.ft.com/content/75ed449d-e9fd-41de-96bd-c92d316651da (accessed:06/01/2023).

Jiménez, A.M. (2020). Value Creation: A Guiding Light for the Interpretation of Tax Treaties? Bull. Intl. Taxn, 74(4/5).

Kahneman, D. (2011). Thinking Fast and Slow. Penguin Pockets.

Lemley, M.A. (2015). IP in a World without Scarcity. NyUL Rev., 90, 460.

Lepak, D.P., Smith, K.G., & Taylor, M.S. (2007). Value creation and value capture: A multilevel perspective. Academy of management review, 32(1), 180.

Magalhães, T.D., & Christians, A. (2020). Rethinking tax for the digital economy after COVID-19. Harv. Bus. L. Rev. Online, 11, 1.

Mauboussin, M.J. (2012). The success equation: Untangling skill and luck in business, sports, and investing. Harvard Business Review Press.

Mazzucato, M. (2018). The Enterpreneurial State, Debunking Public versus Private Sector Myths. Penguin Books.

Mlodinow, L. (2008). The Drunkard’s Walk, How Randomness Rules Our Lives. Penguin Books.

Phelps, E.S. (1986). Profits Theory and Profits Taxation. International Monetary Fund.

Rikap, C. (2022). Amazon: A story of accumulation through intellectual rentiership and predation. Competition & Change, 26(3–4), 436.

Schwerhoff, G., Edenhofer, O., & Fleurbaey, M. (2020). Taxation of economic rents. Journal of Economic Surveys, 34(2), 398.

Shay, S.E. (2021). The Deceptive Allure of Taxing “Residual Profits”, Bull. Intl. Taxn., 75(11/12).

Stratford, B. (2020). The threat of rent extraction in a resource-constrained future. Ecological economics, 169(106524), 1.

Topham, G. (2021). Fresh calls for a windfall tax on companies that prospered during Covid, The Guardian. Retrieved from: https://www.theguardian.com/politics/2021/sep/20/fresh-calls-for-windfall-tax-oncompanies-that-prospered-during-covid (accessed: 06/01/2023).

Vodovic, L. (2022). Industries Most and Least Impacted by COVID-19 from a Probability of Default Perspective – January 2022 Update, S&P Global. Retrieved from:

https://www.spglobal.com/marketintelligence/en/news-insights/blog/industries-most-and-least-impacted-by-covid-19-from-a-probability-of-default-perspective-january-2022-update (accessed: 06/01/2023).

Wright, J., & Zhu, B. (2018). Monopoly rents and foreign direct investment in fixed assets. International Studies Quarterly, 62(2), 341.

Other resources:

HFS (2022). Tech sector got COVID-19 ‘windfall’ of $100 billion: HFS Research. Retrieved from: https://www.hfsresearch.com/news/tech-sector-got-covid-19-windfall-of-100-billion-hfs-research/ (accessed: 06/01/2023).

Luxembourg and Others v. Commission (Amazon) (2021), T-816/17 and T-318/18, GC Decision.

MarketWatch, Tritax Big Box REIC. Retrieved from: https://www.marketwatch.com/investing/stock/4zq/company-profile?countrycode=de&iso=xfra (accessed: 06/01/2023).

OECD (2020). Tax Challenges Arising from Digitalisation – Report on Pillar One Blueprint.

OECD (2022). Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations.

Sure Dividend Research for 2021. Retrieved from: https://www.suredividend.com

WHO Watch Team (2022). Private monopolies hinder progress on public health: intellectual property at the 75th World Health Assembly, PeoplesDispatch. Retrieved from: https://peoplesdispatch.org/2022/06/12/private-monopolies-hinder-progress-on-publichealth-intellectual-property-at-the-75th-world-healthassembly/ (accessed: 06/01/2023).

Pobrania

Opublikowane

Wersje

- 2024-03-22 - (2)

- 2023-08-31 - (1)

Jak cytować

Numer

Dział

Licencja

Utwór dostępny jest na licencji Creative Commons Uznanie autorstwa – Użycie niekomercyjne 4.0 Międzynarodowe.

Autor (Autorzy) artykułu oświadcza, że przesłane opracowanie nie narusza praw autorskich osób trzecich. Wyraża zgodę na poddanie artykułu procedurze recenzji oraz dokonanie zmian redakcyjnych. Przenosi nieodpłatnie na Oficynę Wydawniczą SGH autorskie prawa majątkowe do utworu na polach eksploatacji wymienionych w art. 50 Ustawy z dnia 4 lutego 1994 r. o prawie autorskim i prawach pokrewnych – pod warunkiem, że praca została zaakceptowana do publikacji i opublikowana.

Oficyna Wydawnicza SGH posiada autorskie prawa majątkowe do wszystkich treści czasopisma. Zamieszczenie tekstu artykuły w repozytorium, na stronie domowej autora lub na innej stronie jest dozwolone o ile nie wiąże się z pozyskiwaniem korzyści majątkowych, a tekst wyposażony będzie w informacje źródłowe (w tym również tytuł, rok, numer i adres internetowy czasopisma).

Osoby zainteresowane komercyjnym wykorzystaniem zawartości czasopisma proszone są o kontakt z Redakcją.

Autor zgadza się na dalsze udostępnianie pracy wg wymagań licencji CC-BY-NC