Stałe zakłady w świetle Filarów – znaczenie analizy cen transferowych

DOI:

https://doi.org/10.33119/ASCASP.2023.1.3Słowa kluczowe:

ceny transferowe, Filar I, Filar II, stały zakładAbstrakt

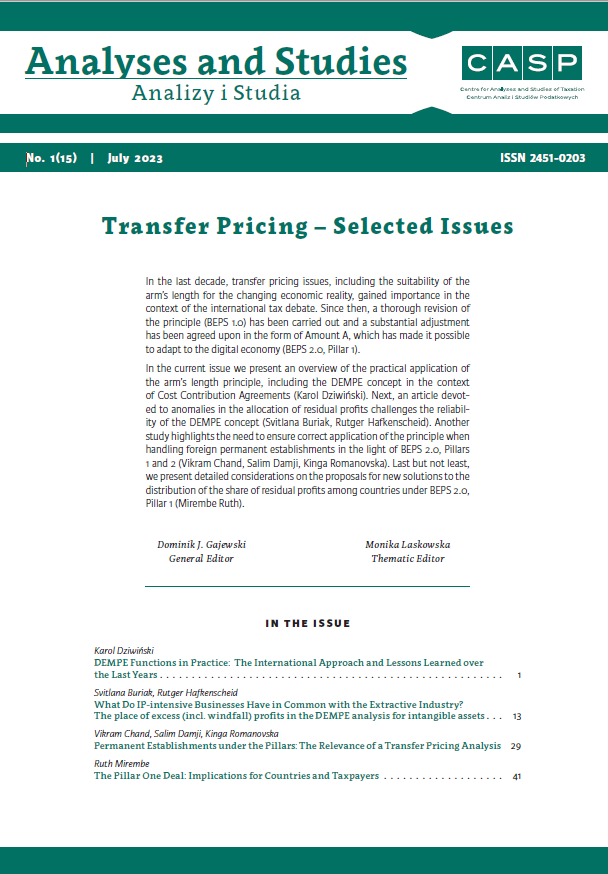

W artykule przeanalizowano sposób podejścia do stałych zakładów w ramach Filaru I oraz II OECD. Porusza się w nim złożoną tematykę globalnych zasad przeciwdziałania erozji podstawy opodatkowania (GloBE) oraz kwalifikowanego krajowego minimalnego podatku wyrównawczego (QDMTT) w ramach Filaru II, a także ponownego przydziału praw podatkowych w ramach Filaru I. Analizowana jest rola cen transferowych w kontekście podejścia do stałych zakładów, a w szczególności ich wpływ na obliczanie skorygowanego dochodu do celów GloBE oraz zysku eliminacyjnego. Praktyczne implikacje tych zasad dla stałych zakładów zilustrowano za pomocą studiów przypadku. W artykule podkreślono także, że potencjalnie może dochodzić do sporów, jak również potrzebę uzyskiwania zawczasu pewności w zakresie pozycji przedsiębiorstwa w kontekście cen transferowych.

Bibliografia

OECD (2010). Report on the Attribution of Profits to Permanent Establishments. Retrieved from: https://www.oecd.org/ctp/transfer-pricing/45689524.pdf

OECD (2017). Commentary on the Model Tax Convention on Income and on Capital.

OECD (2018). Additional Guidance on the Attribution of Profits to Permanent Establishments, BEPS Action 7. Retrieved from: https://www.oecd.org/tax/transferpricing/additional-guidance-attribution-of-profits-topermanent-establishments-BEPS-action-7.pdf

OECD (2021). Tax Challenges Arising from the Digitalisation of the Economy – Global Anti-Base Erosion Model Rules (Pillar Two): Inclusive Framework on BEPS. Retrieved from: https://www.oecd.org/tax/beps/tax-challenges-arising-from-the-digitalisation-of-the-economyglobal-anti-base-erosion-model-rules-pillar-two.pdf

OECD (2022a). Bilateral Advance Pricing Arrangement Manual. Retrieved from: https://www.oecd.org/publications/bilateral-advance-pricing-arrangement-manual-4aa570e1-en.htm

OECD (2022b). Progress Report on Amount A of Pillar One, Two-Pillar Solution to the Tax Challenges of the Digitalisation of the Economy. Retrieved from: https://www.oecd.org/tax/beps/progress-report-on-amounta-of-pillar-one-july-2022.pdf

OECD (2022c). Tax Challenges Arising from the Digitalisation of the Economy – Commentary to the Global Anti- Base Erosion Model Rules (Pillar Two). Retrieved from: https://www.oecd.org/tax/beps/tax-challenges-arisingfrom-the-digitalisation-of-the-economy-global-antibase-erosion-model-rules-pillar-two-commentary.pdf

OECD (2022d). Tax Challenges Arising from the Digitalisation of the Economy –Global Anti-Base Erosion Model Rules (Pillar Two) Examples. Retrieved from: https://www.oecd.org/tax/beps/taxchallenges-arising-fromthe-digitalisation-of-the-economy-global-anti-baseerosion-model-rules-pillar-two-examples.pdf

OECD (2022e). Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations.

OECD (2023a). Manual on the Handling of Multilateral Mutual Agreement Procedures and Advance Pricing Arrangements. Retrieved from: https://www.oecd-ilibrary.org/docserver/f0cad7f3-en.pdf?expires=1688055608&id=id&accname=guest&checksum=A4410B91FC6CDD0EDFE1A28A1B759115

OECD (2023b). Tax Challenges Arising from the Digitalisation of the Economy – Administrative Guidance on the Global AntiBase Erosion Model Rules (Pillar Two).

Retrieved from: https://events.ataftax.org/index.php?page=documents&func=view&document_id=79

Journals

Chand, V. & Lembo, G. (2020). Intangible-Related Profit Allocation within MNEs based on Key DEMPE Functions: Selected Issues and Interaction with Pillar One and Pillar Two of the Digital Debate. International Tax Studies, 3(6). Retrieved from: https://www.ibfd.org/shop/journal/intangible-related-profit-allocationwithin-mnes-based-key-dempe-functions-selected

Chand, V., Turina, A., & Ballivet, L. (2020). Profit Allocation within MNEs in Light of the Ongoing Digital Debate on Pillar I – A “2020 Compromise”?: From Using A Facts and Circumstances Analysis or Allocation Keys to Predetermined Allocation Approaches. World Tax J., 12, 565–619. Drobnik, P. (2018). The Attribution of Profits to a Dependent Agent PE – If the Dependent Agent Is a Commissionaire (Wholly Owned Subsidiary) of the Principal. International Transfer Pricing Journal, 25(3).

Dziurdź, K., (2014). Attribution of Functions and Profits to a Dependent Agent PE: Different Arm’s Length Principles under Articles 7(2) and 9? World Tax Journal, 6(2).

Gramm, C. (2020). Profit Attribution to a Fixed Place Permanent Establishment: Case Study – Showroom. International Transfer Pricing Journal, 27(2).

Martin, C., Chand, V. & Burkhalter, N. (2020). Arm’s Length Principle from a Swiss Perspective: Profit Allocation to Inbound and Outbound Permanent Establishments. Intertax,50(1).

Ruberti, R. (2022). Applying the AOA to a PE That Performs Services: A Case Study on the Balance Sheet and the Profit and Loss Account of the Branch. International Transfer Pricing Journal, 29(3).

National/Regional legislation

ATAF (2022). ATAF Suggested Approach to Drafting Digital Services Tax Legislation.

IN: India Ministry of Finance, Public Consultation on the proposal for the amendment of rules for profit attribution to permanent establishments. Retrieved from: https://www.indianembassyusa.gov.in/pdf/taxcorner/Public_consultation_apr18.pdf

NL: Decree on the Attribution of Profits to Permanent Establishments (Besluit winstallocatie vaste inrichtingen 2022 – BWBR0046838), (2022, 2 July).

UK: Draft Legislation on multinational top-up tax (2022). Retrieved from: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1092586/Draft_legislation.pdf

UK: HMRC, INTM267100 – Non-residents trading in the

UK: profits of the PE. Retrieved from: https://www.gov.uk/hmrc-internal-manuals/international-manual/intm267100

UK: HMRC, INTM267050 – Non-residents trading in the

UK: profits of the PE: Attribution – method of calculation of chargeable profits (2022 update). Retrieved from: https://www.gov.uk/hmrc-internal-manuals/international-manual/intm267050

Other sources

Tax Foundation (2021). Corporate Tax Rates around the World. Retrieved from: https://taxfoundation.org/publications/corporate-tax-rates-around-theworld/#Highest

Pobrania

Opublikowane

Wersje

- 2024-03-22 - (2)

- 2023-08-31 - (1)

Jak cytować

Numer

Dział

Licencja

Autor (Autorzy) artykułu oświadcza, że przesłane opracowanie nie narusza praw autorskich osób trzecich. Wyraża zgodę na poddanie artykułu procedurze recenzji oraz dokonanie zmian redakcyjnych. Przenosi nieodpłatnie na Oficynę Wydawniczą SGH autorskie prawa majątkowe do utworu na polach eksploatacji wymienionych w art. 50 Ustawy z dnia 4 lutego 1994 r. o prawie autorskim i prawach pokrewnych – pod warunkiem, że praca została zaakceptowana do publikacji i opublikowana.

Oficyna Wydawnicza SGH posiada autorskie prawa majątkowe do wszystkich treści czasopisma. Zamieszczenie tekstu artykuły w repozytorium, na stronie domowej autora lub na innej stronie jest dozwolone o ile nie wiąże się z pozyskiwaniem korzyści majątkowych, a tekst wyposażony będzie w informacje źródłowe (w tym również tytuł, rok, numer i adres internetowy czasopisma).

Osoby zainteresowane komercyjnym wykorzystaniem zawartości czasopisma proszone są o kontakt z Redakcją.

Autor zgadza się na dalsze udostępnianie pracy wg wymagań licencji CC-BY-NC