Filar pierwszy: jest porozumienie! Kto na nim skorzysta?

DOI:

https://doi.org/10.33119/ASCASP.2023.1.4Słowa kluczowe:

OECD Filar I, negocjowanie ustaleń w ramach filaru I, Filar I, zyski i straty, kompleksowośćAbstrakt

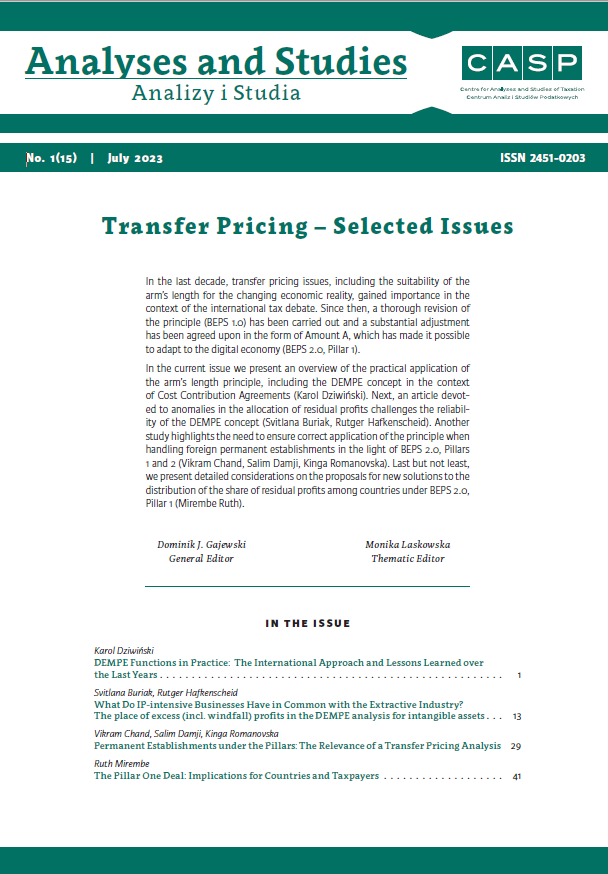

Po wielu latach prób znalezienia wielostronnych rozwiązań wyzwań związanych z cyfryzacją gospodarki, OECD przedstawiła w 2019 r. propozycję Filaru I. Projekt ten przenosi prawa podatkowe do jurysdykcji rynkowych w oparciu o jednolitą metodę. Propozycja jest wynikiem negocjacji między krajami, przy udziale organizacji międzynarodowych i przedsiębiorstw wielonarodowych. Jak w przypadku każdej umowy, istnieją zyski i straty – tyle że w tym przypadku skutki dotyczą również podmiotów, które nie są stronami umowy (wśród nich podatników). W artykule autorka omawia umowę w ramach pierwszego filaru, analizując potencjalne korzyści i straty dla państw oraz podatników.

Bibliografia

Brauner, Y. (2003). An International Tax Regime in Crystallization. TAX LAW REVIEW, 56, 259–328.

Brauner, Y. (2014). What the BEPS. Florida Tax Review, 16(2), 55–115.

Brosens, L., & Bossuyt, J. (2020). Legitimacy in International Tax Law-Making: Can the OECD Remain the Guardian of Open Tax Norms? World Tax Journal, 313–376.

Chowdhury, A. (2019, 29 Oct). OECD is not the right place to reform international tax rules.’ Independent Commission for the Reform of International Corporate Taxation. Retrieved from: https://www.icrict.com/icrict-in-thenews/2019/10/29/oecd-is-not-the-rightplace-to-reform-international-tax-rules

Christians, A. (2016). TAXPAYER RIGHTS IN THE UNITED STATES. Derecho Tributario Y Derechos Humanos/ tax Law And Human Rights [Preprint]. Retrieved from: https://ssrn.com/abstract=2809750

Cockfield, A. (2006, spring). The rise of the OECD as an informal world tax organisation though national responses to e-commerce tax challenges. Yale Journal of Law & Technology, 136–187

Colliard, J.-E., & Eden, L. (2021). Tax Complexity and Transfer Pricing Blueprints, Guidelines, and Manuals. Tax Management International Journal, 50(2).

Corlin Christensen, R., Hearson, M., & Randriamanalina, T. (2020). At the Table, Off the Menu? Assessing the Participation of Lower-Income Countries in Global Tax Negotiations. Institute of Development Studies (IDS). Retrieved from: https://doi.org/10.19088/ICTD.2020.004

Eden, L. (2021a). The Simple Analytics of Pillar One Amount A. Tax Manangement International Journal, 50(3), 137–142.

Eden, L. (2021b). Winners and Losers: U.S. Country and Industry Estimates of Pillar One Amount A. Tax Management International Journal, 50(5). Retrieved from: https://ssrn.com/abstract=3841813

Finley, R. (2023). Amount B Holds Promise, But It Needs Work. Tax Notes Internatioal, 109, 18–24.

Greil, S. et al. (2023). Towards an Amended Arm’s Length

Principle – Tackling complexity and implementing destination rules in transfer pricing. Intertax, 51(4), 272–289. Retrieved from: https://doi.org/10.2139/ssrn.4166972

Hanappi, T., & González Cabral, A.C. (2022). The impact of the international tax reforms under Pillar One and Pillar Two on MNE’s investment costs. International Tax and Public Finance, 29(6), 1495–1526. Retrieved from: https://doi.org/10.1007/s10797-022-09750-0

Herzfeld, M. (2023). Developing Countries: Victims or Victors? Tax Notes International, 109, 1085–1089.

Lees, A., & Akol, D. (2021). There and Back Again: The

Making of Uganda’s Mobile Money Tax. Institute of Development Studies (IDS). Retrieved from: https://doi.org/10.19088/ICTD.2021.012

Magalhaes, T.D. (2018). What Is Really Wrong with Global Tax Governance and How to Properly Fix It. World Tax Journal, 499–536.

Magwape, M. (2022). Debate: Unilateral Digital Services

Tax in Africa; Legislative Challenges and Opportunities. Intertax, 50(5), 444–458. Retrieved from: https://doi.org/10.54648/TAXI2022039

MarketForces Africa (2021, 30 Nov). FIRS Explains Nigeria Refusal to Sign OECD Corporate Tax Agreement. MarketForces Africa. Retrieved from: https://dmarketforces.com/firs-explains-nigeriarefusal-to-sign-oecdcorporate-tax-agreement/ (accessed: 5 February 2023)

OECD (2020). Tax Challenges Arising from Digitalisation – Report on Pillar One Blueprint: Inclusive Framework on BEPS. OECD (OECD/G20 Base Erosion and Profit Shifting Project). Retrieved from: https://doi.org/10.1787/beba0634-en

OECD (2021). Developing Countries and the OECD/G20 Inclusive Framework on BEPS: OECD Report for the G20 Finance Minsiters and the Central Bank Governors. Paris: OECD.

OECD (2022a). Progress Report on Amount A of Pillar One. Paris: OECD.

OECD (2022b). Progress Report on the Administration and Tax Certainty Aspects of Pillar One. OECD. Retrieved from: https://www.oecd.org/tax/beps/progress-report-administration-tax-certainty-aspects-of-amounta-pillar-one-october-2022.pdf

OECD (2022c). Public consultation document: Pillar One – Amount A: Draft Model Rules for Domestic Legislation on Scope. Paris: OECD.

OECD (2022d). Public consultation document: Pillar One – Amount A: Draft Model Rules for Nexus and Revenue Sourcing. Paris: OECD.

OECD (2022e). Public consultation document: Pillar One – Amount A: Draft Model Rules for Tax Base Determinations. Paris: OECD.

OECD (2022f). Public consultation document: Pillar One – Amount A: Draft Multilateral Convention Provisions on Digital Services Taxes and Other Relevant Similar Measures. OECD.

OECD (2022g). Public Consultation Document: Pillar One – Amount A: Extractives Exclusion. Paris: OECD.

OECD (2023). Economic Impact Assessment of the Two-Pillar Solution: Revenue Estimates for Pillar One & Pillar Two. Webinar: Economic Impact Assessment of the Two-Pillar Solution, Online webinar, 18 January. Retrieved from: https://www.oecd.org/tax/beps/economic-impact-assessment-presentation-january-2023.pdf

Riberio, S. (2020). Fighting Tax Fraud Through Artificial Intelligence Tools: Will the Fundamental Rights of Taxpayers Survive the Digital Transformation of Tax Administrations? European Taxation, 60(6).

Ring, D.M. (2008). What’s at Stake in the Sovereignty Debate?: International Tax and the Nation-State. Virginia Journal of International Law, 49, 55–234.

Saldivar, F.C. (2021). Ethics & International Affairs’, Is a Bad Deal Better than no Deal?: A Perspective from Africa on the G7’s Agreement to Restructure International Corporate Taxation, 22 November. Retrieved from: https://www.ethicsandinternationalaffairs.org/online-exclusives/is-a-bad-deal-better-than-no-deal-aperspective-from-africa-on-the-g7s-agreement-to-restructure-international-corporate-taxation

Starkov, V., & Jin, A. (2022). A TOUGH CALL? COMPARING TAX REVENUES TO BE RAISED BY DEVELOPING COUNTRIES FROM THE AMOUNT A AND THE UN MODEL TREATY ARTICLE 12B REGIMES. 156. South Centre.

Tandon, S. (2020). Pillar One Blueprint: Towards Global Solution? SSRN Electronic Journal [Preprint]. Retrieved from: https://doi.org/10.2139/ssrn.3748550

Tanzi, V. (2013). Lakes, Oceans, and Taxes: Why the World Needs a World Tax Authority. Tax and Global Justice, London.

The Intergovernmental Group of Twenty-Four on International Monetary Affairs and Development (2022). Promotion of Inclusive and Effective Tax Cooperation at the United Nations. The Intergovernmental Group of Twenty-Four on International Monetary Affairs and Development.

Tychma, A. (2021). The OECD as the Future International Tax Organization: An Inevitable Course of Events? Intertax, 49(8 & 9), 614–635.

Wardell-Burrus, H. (2022). Preliminary observations on the imposition of the tax liability and elimination of double taxation under the OECD Secretariat’s Progress Report on Amount A of Pillar One. SSRN Electronic Journal [Preprint]. Available at: https://doi.org/10.2139/ssrn.4160616

White, J., Reeves, L., & Taho, S. (2022, 25 Nov). This week in tax: UN votes to take tax leadership role International Tax Review. Retrieved from: https://www.internationaltaxreview.com/faqs

de Wilde, M. (2022). International Company Tax Developments and Some Reflections on Way foward for the African Continent. Intertax, 50(5), 459–465.

Pobrania

Opublikowane

Wersje

- 2024-03-22 - (2)

- 2023-08-31 - (1)

Jak cytować

Numer

Dział

Licencja

Utwór dostępny jest na licencji Creative Commons Uznanie autorstwa – Użycie niekomercyjne 4.0 Międzynarodowe.

Autor (Autorzy) artykułu oświadcza, że przesłane opracowanie nie narusza praw autorskich osób trzecich. Wyraża zgodę na poddanie artykułu procedurze recenzji oraz dokonanie zmian redakcyjnych. Przenosi nieodpłatnie na Oficynę Wydawniczą SGH autorskie prawa majątkowe do utworu na polach eksploatacji wymienionych w art. 50 Ustawy z dnia 4 lutego 1994 r. o prawie autorskim i prawach pokrewnych – pod warunkiem, że praca została zaakceptowana do publikacji i opublikowana.

Oficyna Wydawnicza SGH posiada autorskie prawa majątkowe do wszystkich treści czasopisma. Zamieszczenie tekstu artykuły w repozytorium, na stronie domowej autora lub na innej stronie jest dozwolone o ile nie wiąże się z pozyskiwaniem korzyści majątkowych, a tekst wyposażony będzie w informacje źródłowe (w tym również tytuł, rok, numer i adres internetowy czasopisma).

Osoby zainteresowane komercyjnym wykorzystaniem zawartości czasopisma proszone są o kontakt z Redakcją.

Autor zgadza się na dalsze udostępnianie pracy wg wymagań licencji CC-BY-NC