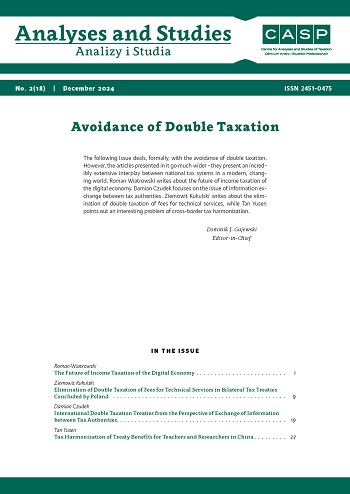

Harmonizacja podatkowa korzyści traktatowych przysługujących nauczycielom i naukowcom w Chinach

DOI:

https://doi.org/10.33119/ASCASP.2024.2.4Słowa kluczowe:

klauzula dot. nauczycieli, umowa o unikaniu podwójnego opodatkowania, harmonizacja podatkowaAbstrakt

Do września 2024 r. Chiny podpisały ponad 100 umów o unikaniu podwójnego opodatkowania z krajami i regionami na całym świecie. Niniejszy artykuł będzie się koncentrował na przepisach dotyczących zwolnień podatkowych dla nauczycieli i naukowców zawartych w dziesiątkach umów o unikaniu podwójnego opodatkowania podpisanych z Chinami, a także na chińskich przepisach krajowych służących do interpretowania zapisów umownych dotyczących zwolnień podatkowych dla nauczycieli i pracowników naukowych. Zwolnienie z podatku wspomniane powyżej zwiększa konkurencyjność nauczycieli i badaczy z krajów będących partnerami traktatowymi Chin na chińskim rynku szkolnictwa wyższego oraz edukacji w ogóle. Z drugiej strony, w przypadku krajów będących partnerami traktatowymi, które nie przewidują zwolnienia z podatku dla nauczycieli i naukowców w umowach o unikaniu podwójnego opodatkowania podpisanych z Chinami, następuje spadek konkurencyjności na chińskim rynku szkolnictwa wyższego i edukacji. Zjawisko to wywołało bardzo interesujący efekt: zachowanie dwustronnej wzajemnej racjonalności przy zawieraniu umowy o unikaniu podwójnego opodatkowania może mieć irracjonalny skutek w kontekście sieci złożonej z ponad stu umów. W artykule omówiono również znaczenie działań obu umawiających się państw na rzecz harmonizacji podatkowej w zakresie szczegółowych przepisów krajowych sformułowanych w celu wdrożenia klauzuli dotyczącej nauczycieli zapisanej w umowach tych państw o unikaniu podwójnego opodatkowania, ponieważ róż- nice w tym, jak rygorystycznie są one przestrzegane i jak skomplikowany jest proces ich wdrażania oraz ratyfikacji, odbiją się na zasadzie wzajemności umowy podatkowej.

Bibliografia

Announcement of the State Administration of Taxation on Further Improvement in Implementation of the Provisions on Teachers and Researchers in Tax Treaties (Announcement of the State Administration of Taxation No. 91 of 2016).

Announcement of the State Administration of Taxation on Implementation of the Provisions on Teachers and Researchers Contained in Tax Treaties (Announcement of the State Administration of Taxation No. 42 of 2011).

Announcement of the State Administration of Taxation on Promulgating the Administrative Measures for Non-Resident Taxpayers to Claim Tax Treaty Benefits (Announcement of the State Administration of Taxation No. 60, 2015).

Announcement of the State Administration of Taxation on Promulgating the Administrative Measures for Non-Resident Taxpayers to Enjoy Treaty Benefits (Announcement of the State Administration of Taxation No. 35 of 2019).

Article 20 (regarding teachers and researchers) of the Agreement between the Government of the People’s Republic of China and the Government of the Polish People’s Republic for the Avoidance of Double Taxation and Prevention of Fiscal Evasion with Respect to Taxes on Income. The treaty was signed on 7 June 1988 and has been effective from 7 January 1989 and applicable since 1 January 1990.

Larkins, E.R. (1987, fall). Journal of the American Taxation Association [JATA], 9(1), p. 48.

Notice on Handling Individual Income Tax Reduction and Exemption for Foreign Personnel, obtained from the official website of the International Office and Hong Kong, Macao and Taiwan Affairs Office at the Sichuan University, http://global.scu.edu.cn/?channel/49/192/_/1716 (accessed: 3.12.2020).

Notice of the State Administration of Taxation on Clarifying the Scope of Application of the Provisions on Teachers and Researchers in Tax Treaties Signed by China (Guo Shui Han (1997), No. 37).

Ostrovsky, I. (2019). Tax Treaties and Special Considerations for Unemployment Income. The Contemporary Tax Journal [CTJ],8(1), Art. 6, pp. 35–37. Sęk, M. (2023). The Remuneration of Teachers and Researchers under Art. 21 of the Brazil-Poland Double Taxation Convention of 2022 in the light of the Polish Treaty Practice. Kwartalnik Prawa Podatkowego [Tax Law Quarterly]. 4. State Administration of the PRC. All the double tax treaties signed by China with its treaty partners, https://www.chinatax.gov.cn/chinatax/n810341/n810770/common_list_ssty.html (assessed: 5.12.2024).

ZHU Xiaodan, PEI Zhaobin (2015). The Argument on the Applicability of the Teacher and Researcher Provision in Double Tax Treaties. [The title of the paper in Chinese: 论中国税收协定教师和研究人员条款的适用]. International Taxation in China, [the name of the journal in Chinese: 国际税收], 9.

Pobrania

Opublikowane

Jak cytować

Numer

Dział

Licencja

Utwór dostępny jest na licencji Creative Commons Uznanie autorstwa – Użycie niekomercyjne 4.0 Międzynarodowe.

Autor (Autorzy) artykułu oświadcza, że przesłane opracowanie nie narusza praw autorskich osób trzecich. Wyraża zgodę na poddanie artykułu procedurze recenzji oraz dokonanie zmian redakcyjnych. Przenosi nieodpłatnie na Oficynę Wydawniczą SGH autorskie prawa majątkowe do utworu na polach eksploatacji wymienionych w art. 50 Ustawy z dnia 4 lutego 1994 r. o prawie autorskim i prawach pokrewnych – pod warunkiem, że praca została zaakceptowana do publikacji i opublikowana.

Oficyna Wydawnicza SGH posiada autorskie prawa majątkowe do wszystkich treści czasopisma. Zamieszczenie tekstu artykuły w repozytorium, na stronie domowej autora lub na innej stronie jest dozwolone o ile nie wiąże się z pozyskiwaniem korzyści majątkowych, a tekst wyposażony będzie w informacje źródłowe (w tym również tytuł, rok, numer i adres internetowy czasopisma).

Osoby zainteresowane komercyjnym wykorzystaniem zawartości czasopisma proszone są o kontakt z Redakcją.

Autor zgadza się na dalsze udostępnianie pracy wg wymagań licencji CC-BY-NC