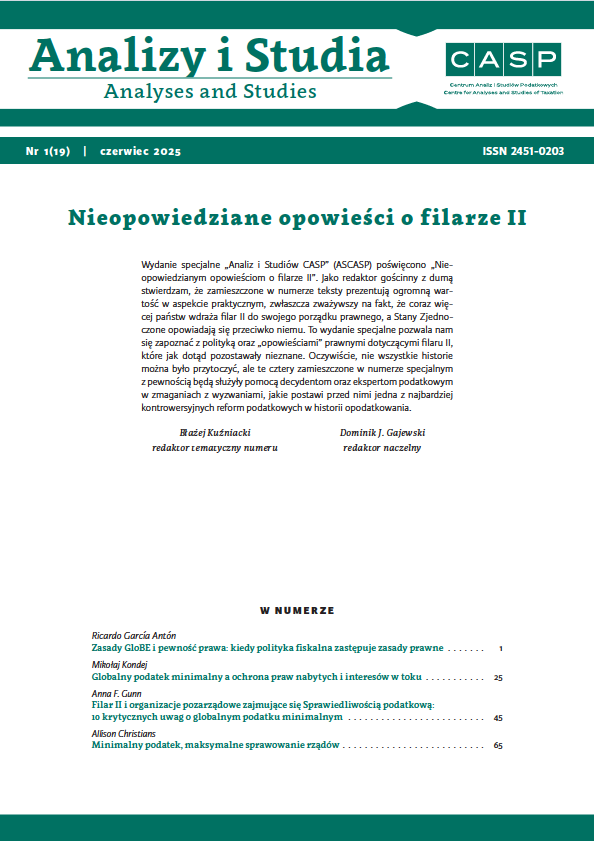

Globalny podatek minimalny a ochrona praw nabytych i interesów w toku

DOI:

https://doi.org/10.33119/ASCASP.2025.1.2Słowa kluczowe:

globalny podatek minimalny, podatek wyrównawczy, zasady modelowe OECD, filar drugi, ochrona praw nabytych, ochrona uzasadnionych oczekiwań, ochorna interesów w toku, podatek odroczony, zachęty podatkowe, uzasadnione oczekiwania, pewność prawa, sprawiedliwe traktowanie, JEL: K34Abstrakt

Artykuł poświęcono analizie, czy globalny podatek minimalny, stanowiący filar II międzynarodowej reformy podatkowej, może naruszać zasady ochrony praw nabytych i uzasadnionych oczekiwań. Wskazano w nim, że wprowadzenie globalnego podatku minimalnego może prowadzić do naruszenia obietnic złożonych przez rządy międzynarodowym przedsiębiorstwom, w szczególności w obszarze ulg podatkowych. Podkreślono, że zarówno przewidziane w zasadach modelowych reguły przejściowe, przewidujące możliwość wykorzystania aktywów z tytułu podatku odroczonego pochodzącego sprzed okresu GLOBE, jak i zwolnienie ze względu na substrat majątkowo-osobowy, mogą nie być wystarczające, aby zapobiec takim naruszeniom. W związku z tym w tekście przenalizowano możliwe środki prawne, którymi dysponują przedsiębiorstwa wielonarodowe, by zakwestionować ewentualne naruszenia. Rozważono możliwość skutecznego zakwestionowania podatku wyrównawczego pobieranego w oparciu o: mechanizm krajowego kwalifikowanego podatku wyrównawczego, zasadę włączenia dochodu do opodatkowania oraz zasadę niedostatecznie opodatkowanych zysków. W konkluzjach stwierdzono, że fakt, że w ramach globalnego podatku minimalnego nie przewidziano mechanizmów ochrony praw nabytych i innych praw podstawowych, rodzi poważne zastrzeżenia.

Bibliografia

ACA Europe (2016). The Protection of Legitimate Expec- tations in Administrative Law and EU Law. Gen- eral Report, Internet: https://www.aca-europe.eu/ seminars/2016_Vilnius/VIL_GeneralReport_en.pdf (dostęp: 19.06.2025) Avi-Yonah, R.S. (2024). Can Investment Treaties Defeat Pillar 2?, Tax Notes International, 114(6), s. 877–880.

Bammens, N., Bettens, D. (2023). The Potential Impact of Pillar Two on Tax Incentives, Intertax, 51(2), s. 155–169.

Biggs, J. (2021). The Scope of Investors’ Legitimate Expectations under the FET Standard in the Euro- pean Renewable Energy Cases, ICSID Review – For- eign Investment Law Journal, 2021, s. 1–30.

Brauner, Y. (2023). The Rule of Law and Rule of Reason in the Aftermath of BEPS, Intertax, 51(4), s. 268–271.

Broggini, G. (1966). Retroactivity of laws in the roman perspective, Irish Lawyer, 151, s. 151–170.

Brokelind, C. (2021). An Overview of Legal Issues Arising from the Implementation in the European Union of the OECD’s Pillar One and Pillar Two Blueprint, Bulle- tin for International Taxation, 75(5), s. 212–219.

Campbell, C. (2013). House of Cards: The Relevance of Legitimate Expectations under Fair and Equitable Treatment Provisions in Investment Treaty Law, Jour- nal of International Arbitration, 30(4), s. 361–379.

Chand, V., Turina, A., Romanovska, K. (2021). Tax Treaty Obstacles in Implementing the Pillar Two Global Mini- mum Tax Rules and a Possible Solution for Eliminating

the various challenges, https://papers.ssrn.com/sol3/ papers.cfm?abstract_id=3967198 (dostęp: 19.06.2025).

De Ambrosis Vigna, A., Kijowski, D.R. (2018). The Prin- ciple of Legitimate Expectations and the Protection of Trust in the Polish Administrative Law, Białostockie Studia Prawnicze, 23/2, s. 39–52.

De Wilde, M. (2022) Why Pillar Two Top-Up Taxation Requires Tax Treaty Modification, Kluwer International Tax Blog, https://kluwertaxblog.com/2022/01/12/ why-pillar-two-top-up-taxation-requires-tax-trea- ty-modification/ (dostęp: 19.06.2025).

De Wilde, M. (2024). On Pillar 2 Controversy and Trust, Kluwer International Tax Blog, https://kluwertaxblog. com/2024/06/11/on-pillar-2-controversy-and-trust/ (dostęp: 19.06.2025).

Debelva, F., De Broe, L. (2022). An Analysis of the IIR and UTPR from an International Customary Law, Tax Treaty Law and European Union Law Perspective, Intertax, 50(12), s. 898–906.

Dourado, A. (2022). The Pillar Two Top-Up Taxes: Inter- play, Characterization, and Tax Treaties, Intertax, 50(5), s. 388–395.

Drabkin-Reiter, E. (2015). The Europeanisation of the law on legitimate expectations. Recent case law of the English and European Union courts on the protection of legitimate expectations in administrative law, https:// cadmus.eui.eu/bitstream/handle/1814/40324/2015_ Drabkin-Reiter_LLM.pdf (dostęp: 19.06.2025).

Dworkin, R.M. (1977). The Model of Rules, University of Chicago Law Review, 35, s. 14–46.

Fisch, J.E. (1997). Retroactivity and legal change: an equilibrium approach, Harvard Law Review, 110(5), s. 1056–1123.

Garcia-Amador, F.V. (1959). Fourth report on State Responsibility. W: Yearbook of the International Law Commission, United Nations, s. 1–19.

Haslehner, W. (2023). The Costs of Pillar 2: Legitimacy, Legality, and Lock-in, Intertax, 51(10), s. 634–637.

Jackowski, M. (2008). Zasada ochrony praw nabytych w polskim prawie konstytucyjnym, Przegląd Sej- mowy, 1(84), s. 11–28.

Kaeckenbeeck, G.G. (1936). The Protection of Vested Rights in International Law, British Year Book of Inter- national Law, 17, s. 15.

Kałduński, M. (2019). Some remarks on the protection of legitimate expectations in international investment law, Compar.tive Law Review, 220/2016, s. 215–238.

Kondej, M. (2025). Wybrane elementy globalnego podatku minimalnego grożące naruszeniem zasady rządów prawa. W: Globalny podatek minimalny.

Opodatkowanie wyrównawcze jednostek wchodzą- cych w skład grup międzynarodowych i krajowych, D. Gajewski, M. Laskowska (eds.). Warszawa: Wolters Kluwer Polska, s. 149–160.

Kryvoi, Y., Matos, S. (2021). Non-Retroactivity as a Gen- eral Principle of Law, Utrecht Law Review, 17(1), s. 46–58.

Kuźniacki, B., Visser, E. (2024). Tax and Non-Tax-Related Challenges of Pillar 2 for Non-Advanced Economies, Tax Notes International, 6 May, s. 881–898.

Kuźniacki, B. (2023). Pillar 2 and International Invest- ment Agreements: ‘QDMTT Payable’ Seals an Interna- tionally Wrongful Act, Tax Notes International, Oct. 9, s. 159–177.

Laliye, S.A. (2008). The Doctrine of Acquired Rights. W: Rights and duties of private investors abroad, South- western Legal Foundation. International and Compar- ative Law Center, s. 145–200.

Lemańska, J. (2016). Uzasadnione oczekiwania w per- spektywie prawa krajowego i regulacji europejskich.

Warszawa: Wolters Kluwer Polska.

Liotti, B.F., Ndubai, J.W., Wamuyu, R., Lazarov, I., Owens, J. (2022). The treatment of tax incentives under Pillar Two, https://unctad.org/system/files/official-docu- ment/diaeia2022d3a2_en.pdf (dostęp 19.06.2025).

MacCormick, N. (1984). Die Rechtsstaat und die rule of law, Juristische Zeitung, 2, s. 65–70.

Manson, R. (2022). A Wrench in GLOBE’s Diabolical Machinery, Tax Notes International, 107, September 19, s. 1391–1395.

Masuda, T. (2024). The Compatibility of the UTPR and Japan’s Tax Treaties, Tax Notes International, 114(8), s. 1127–1145.

Nogueira, J.F.S. (2020). GloBE and EU Law: Assessing the Compatibility of the OECD’s Pillar II Initiative on a Minimum Effective Tax Rate with EU Law and Imple- menting It within the Internal Market, World Tax Jour- nal, August 2020, s. 465–498.

Potestà, M. (2013). Legitimate expectations in invest- ment treaty law: Understanding the roots and the limits of a controversial concept, 28 ICSID Review, 2013, s. 88–122, based on preprint: https://lk-k.com/

wp-content/uploads/potesta-legitimate-expecta- tions-inv.-treaty-law-2013.pdf (dostep: 19.06.2025).

Ridder, L., Ruige, S., de Wilde, M.F. (2023). Fiscal Sub- sidies Aspirers Beware of the No Benefit Requirement in Pillar Two, SRNN, https://papers.ssrn.com/sol3/ papers.cfm?abstract_id=4564923 (dostęp: 19.06.2025) Roes, T. (2023). Sincere cooperation and European inte- gration. A study of the pluriformity of loyalty un EU law, https://kuleuven.limo.libis.be/discovery/fulldisplay? docid=lirias4116124&context=SearchWebhook& vid=32KUL_KUL:Lirias&lang=en&search_scope=lir- ias_profile&adaptor=SearchWebhook&tab=LIR- IAS&query=any,contains,LIRIAS4116124&offset=0 (dostęp: 19.06.2025).

Schmidt-Aßmann, E. (1987). Der Rechtsstaat. W: Hand- buch des Staatsrechts der Bundesrepublik Deutsch- land. Band I. Grundlagen von Staat und Verfassung, J. Isensee, S. Kirchof (eds.). Heidelberg, s. 987–1043.

Schønberg. S.J. (2000). Legitimate Expectations in Administrative Law. Oxford: Oxford University Press.

Schoueri, L.E. (2021). Some Considerations on the Lim- itation of Substance-Based Carve-Out in the Income Inclusion Rule of Pillar Two, Bulletin for international taxation, November/December, s. 543–548.

Soong, S. (2024). U.S. Business Group’s Belgian UTPR Challenge Gains Traction, Tax Notes International, 17 October 2024, https://www.taxnotes.com/tax-notes-to- day-international/oecd-pillar-2-global-minimum-tax- /u.s-business-groups-belgian-utpr-challenge-gains- traction/2024/10/17/7m6fp (dostęp: 19.06.2025).

Staniszewska, L. (2024). Naruszenie zasad ochrony inte- resów w toku uzasadnionych oczekiwań w wybra- nych przykładach materialnego prawa administracyj- nego, Studia Prawnoustrojowe, 66/2024, s. 491–514.

Thomas, R. (2000). Legitimate Expectations and Propor- tionality in Administrative Law. Hart Publishing.

VanderWolk, J. (2022). The UTPR is Inconsistent with the Nexus Requirement of Tax Treaties, Kluwer International Tax Blog, https://kluwertaxblog.com/2022/10/26/the- utpr-is-inconsistent-with-the-nexus-requirement-of- tax-treaties/ (dostęp 19.06.2025).

Vicente, M.N. (2020). Property rights and legitimate expectations under United States constitutional law and the European convention on human rights: some compar.tive remarks, Comperative Law Review, 26/2020, s. 51–96.

Wojciechowski, M. (2014). Pewność Prawa. Gdańsk: Wydawnictwo Uniwersytetu Gdańskiego.

Wongkaew, T. (2019). Protection of Legitimate Expecta- tions in Investment Treaty Arbitration. Cambridge: Cambridge University Press.

Orzecznictwo

CJEU (1975). Judgment of the Court of 10 December 1975.

C-95/74 Union nationale des coopératives agricoles de céréales and others v Commission and Council of the European Communities.

CJEU (2004). Judgment of 29 April 2004 C-487/01 Gemeente Leusden.

CJEU (2005). Judgment of 7 June 2005 Case C-17/03 Vereniging voor Energie.

CJEU (2009). Judgement of 10 September 2009 C-201/08 Plantanol GmbH & Co. KG.

CJEU (2019). Judgement of 23 January 2019 C-419/17 Deza, a.s.

CJEU (2019a). Judgement of 5 March 2019 C-349/17 Eesti Pagar AS.

CJEU (2024). Judgment of 19 September 2024 Case C-198/21 Santini et. al.

ICSID (2013). Award of ICSID Case no. ARB/05/20 Micula, S.C. European Food S.A vs Romania PCA (2020). Cairn Energy PLC and Cairn UK Holdings Limited v. The Republic of India, 21 Dec. 2020.

SCC (2015). SCC Arbitration 2015/150, Foresight Luxem- bourg Solar Sarl, Greentech Energy Systems and GWM Renewable Energy SPA v Spain

Inne

OECD (2020). Tax Challenges Arising from Digitalisa- tion – Report on Pillar Two Blueprint: Inclusive Frame- work on BEPS, OECD/G20 Base Erosion and Profit Shifting Project. Paris: OECD Publishing, https://doi. org/10.1787/abb4c3d1-en.

OECD (2021). Tax Challenges Arising from Digitalisation of the Economy – Global Anti-Base Erosion Model Rules (Pillar Two): Inclusive Framework on BEPS, OECD/G20 Base Erosion and Profit Shifting Project. Paris: OECD Publishing, https://doi.org/10.1787/782bac33-en.

OECD (2022). Tax Incentives and the Global Minimum Corporate Tax: Reconsidering Tax Incentives after the GloBE Rules. Paris: OECD Publishing, https://doi. org/10.1787/25d30b96-en.

OECD (2023). Administrative Guidance on the Global AntiBase Erosion Model Rules (Pillar Two), https:// www.oecd.org/content/dam/oecd/en/topics/poli- cy-sub-issues/global-minimum-tax/administrative- guidance-global-anti-base-erosion-rules-pillar-two- july-2023.pdf.

OECD (2023a). The Pillar Two Rules in a Nutshell, https:// www.oecd.org/content/dam/oecd/en/topics/poli- cy-sub-issues/global-minimum-tax/pillar-two-mod- el-rules-in-a-nutshell.pdf OECD (2024). Tax Challenges Arising from the Digitaliza- tion of the Economy – Consolidated Commentary to the Global Anti-Base Erosion Model Rules (2023): Inclu- sive Framework on BEPS, OECD/G20 Base Erosion and Profit Shifting Project. Paris: OECD Publishing, https://doi.org/10.1787/b849f926-en.

Pobrania

Opublikowane

Jak cytować

Numer

Dział

Licencja

Utwór dostępny jest na licencji Creative Commons Uznanie autorstwa – Użycie niekomercyjne 4.0 Międzynarodowe.

Autor (Autorzy) artykułu oświadcza, że przesłane opracowanie nie narusza praw autorskich osób trzecich. Wyraża zgodę na poddanie artykułu procedurze recenzji oraz dokonanie zmian redakcyjnych. Przenosi nieodpłatnie na Oficynę Wydawniczą SGH autorskie prawa majątkowe do utworu na polach eksploatacji wymienionych w art. 50 Ustawy z dnia 4 lutego 1994 r. o prawie autorskim i prawach pokrewnych – pod warunkiem, że praca została zaakceptowana do publikacji i opublikowana.

Oficyna Wydawnicza SGH posiada autorskie prawa majątkowe do wszystkich treści czasopisma. Zamieszczenie tekstu artykuły w repozytorium, na stronie domowej autora lub na innej stronie jest dozwolone o ile nie wiąże się z pozyskiwaniem korzyści majątkowych, a tekst wyposażony będzie w informacje źródłowe (w tym również tytuł, rok, numer i adres internetowy czasopisma).

Osoby zainteresowane komercyjnym wykorzystaniem zawartości czasopisma proszone są o kontakt z Redakcją.

Autor zgadza się na dalsze udostępnianie pracy wg wymagań licencji CC-BY-NC