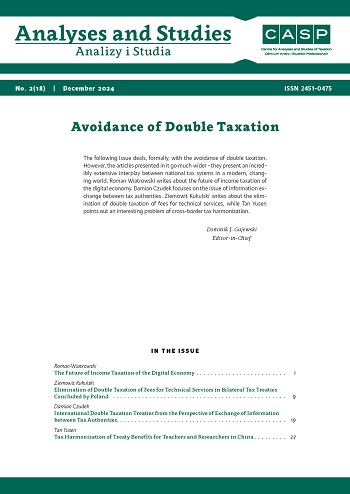

Międzynarodowe umowy o unikaniu podwójnego opodatkowania z perspektywy wymiany informacji między organami podatkowymi

DOI:

https://doi.org/10.33119/ASCASP.2024.2.3Słowa kluczowe:

umowy o unikaniu podwójnego opodatkowania, dyrektywa DAC, wymiana informacji, podmioty podatkowe, administracja podatkowa, współpraca międzynarodowaAbstrakt

W wyniku procesów globalizacyjnych świat coraz bardziej staje otworem, co oddziałuje na liczbę i charakter funkcjonowania podmiotów prawa podatkowego oraz na wpływ czynnika międzynarodowego. Umowy o unikaniu podwójnego opodatkowania stanowią jeden z podstawowych instrumentów polityki podatkowej ukierunkowanej na minimalizowanie naturalnych skutków rządowych regulacji wprowadzanych dla podmiotów podatkowych. Jednakże ze względu na swój charakter każda ulga podatkowa stwarza możliwości unikania opodatkowania, tzn. może być nadużywana przez podmioty podatkowe. Aby złagodzić negatywne skutki z tym związane, w umowach tych zawarto postanowienia umożliwiające wymianę informacji między zainteresowanymi administracjami podatkowymi z zamiarem obniżenia ryzyka, że podmioty będą unikać opodatkowania bądź uchylać się od niego. Celem artykułu jest przedstawienie wyników analizy przepisów dotyczących wymiany informacji zawartych w dwustronnych umowach o unikaniu podwójnego opodatkowania, którymi związana jest Republika Czeska.

Bibliografia

Baccheta P., Espinoza, M.P. (2000). Exchange of Information Clauses in International Tax Treaties. International Tax and Public Finance, 7.

Balco, T. (2018). Specifics of Interpretation and Application of Treaties on Avoidance of Double Taxation. Brno.

Brzeziński, B. (2017). Prawo podatkowe: zagadnienia teorii i praktyki. Toruń.

Dombrowski, J., Buchtová, G. (2022). Mezinárodní výměna informací pohledem správce daně se zaměřením na oblast přímých daní a směrnice EU. Daně a právo v praxi, 6. Wolters Kluwer.

Hamaekers, H. et al. (2006). Wprowadzenie do międzynarodowego prawa podatkowego. Warszawa.

Langenmayr, D., Zyska, L. (2023). Escaping the exchange of information: Tax evasion via citizenship-by-investment. Journal of Public Economics, 221.

Nováková, L., Králová, D. (2024). Daň z příjmů fyzických osob v mezinárodním kontextu. Praha.

Pistone, P. (2002). An EU Model Tax Convention. EC Tax Review.

Radvan, M., Mrkývka, P. et al. (2016). Důchodové daně.

Brno.

Ryder, N., Bourton, S. (2024). To Exchange or Not to Exchange – That is the Question. A Critical Analysis of The Use of Financial Intelligence and the Exchange of

Information in the United Kingdom. Journal of Business, 2024(3).

Wang, M., Zhang, K., Gao, S. (2024). Does Information Exchange Affect Cross-Boarder Tax Avoidance? Evidence From the Common Reporting Standard. China and World Economy, 32(4).

West, A., Wilkinson, B. (2024). What Do We Know About Tax Treaties and How Can Accounting Research Contribute? Journal of International Accounting, Auditing and Taxation, 54.

Pobrania

Opublikowane

Jak cytować

Numer

Dział

Licencja

Utwór dostępny jest na licencji Creative Commons Uznanie autorstwa – Użycie niekomercyjne 4.0 Międzynarodowe.

Autor (Autorzy) artykułu oświadcza, że przesłane opracowanie nie narusza praw autorskich osób trzecich. Wyraża zgodę na poddanie artykułu procedurze recenzji oraz dokonanie zmian redakcyjnych. Przenosi nieodpłatnie na Oficynę Wydawniczą SGH autorskie prawa majątkowe do utworu na polach eksploatacji wymienionych w art. 50 Ustawy z dnia 4 lutego 1994 r. o prawie autorskim i prawach pokrewnych – pod warunkiem, że praca została zaakceptowana do publikacji i opublikowana.

Oficyna Wydawnicza SGH posiada autorskie prawa majątkowe do wszystkich treści czasopisma. Zamieszczenie tekstu artykuły w repozytorium, na stronie domowej autora lub na innej stronie jest dozwolone o ile nie wiąże się z pozyskiwaniem korzyści majątkowych, a tekst wyposażony będzie w informacje źródłowe (w tym również tytuł, rok, numer i adres internetowy czasopisma).

Osoby zainteresowane komercyjnym wykorzystaniem zawartości czasopisma proszone są o kontakt z Redakcją.

Autor zgadza się na dalsze udostępnianie pracy wg wymagań licencji CC-BY-NC